The harsh fact: 9 out of 10 fintech apps are abandoned within the first few weeks.

Why?

The competition is fierce with nearly 30,000 players worldwide. And user expectations have never been higher. Fail to deliver the features they demand? Your app will be in their past.

What's more,

Many fintech apps make big promises they can't keep.

They lure users in with an app that has fascinating features, in the future. But that future never come because the app can’t release feature quickly or catch up with user demands.

In today's landscape, a great fintech app isn't just about basic money transfers - it's about creating a seamless, intuitive experience that feels like a personal financial assistant in your users' pockets.

So how to make them love your apps? Let's walk through the 20 must-have features in this blog

Table of contents [ Hide ]

What is a fintech app?

18 must-have features for fintech apps

1. Seamless onboarding

2. Advanced security measures

3. Intuitive dashboard

4. AI-powered financial insights

5. Multi-account integration

6. Real-time transaction tracking

7. Customizable budgeting tools

8. Investment tracking & guidance

9. Instant money transfer

10. Bill payment & management

11. Credit score monitoring

12. Savings & investment automation

13. Live chat and chat bot integration

14. Expense splitting

15. Receipt & document management

16. International currency support

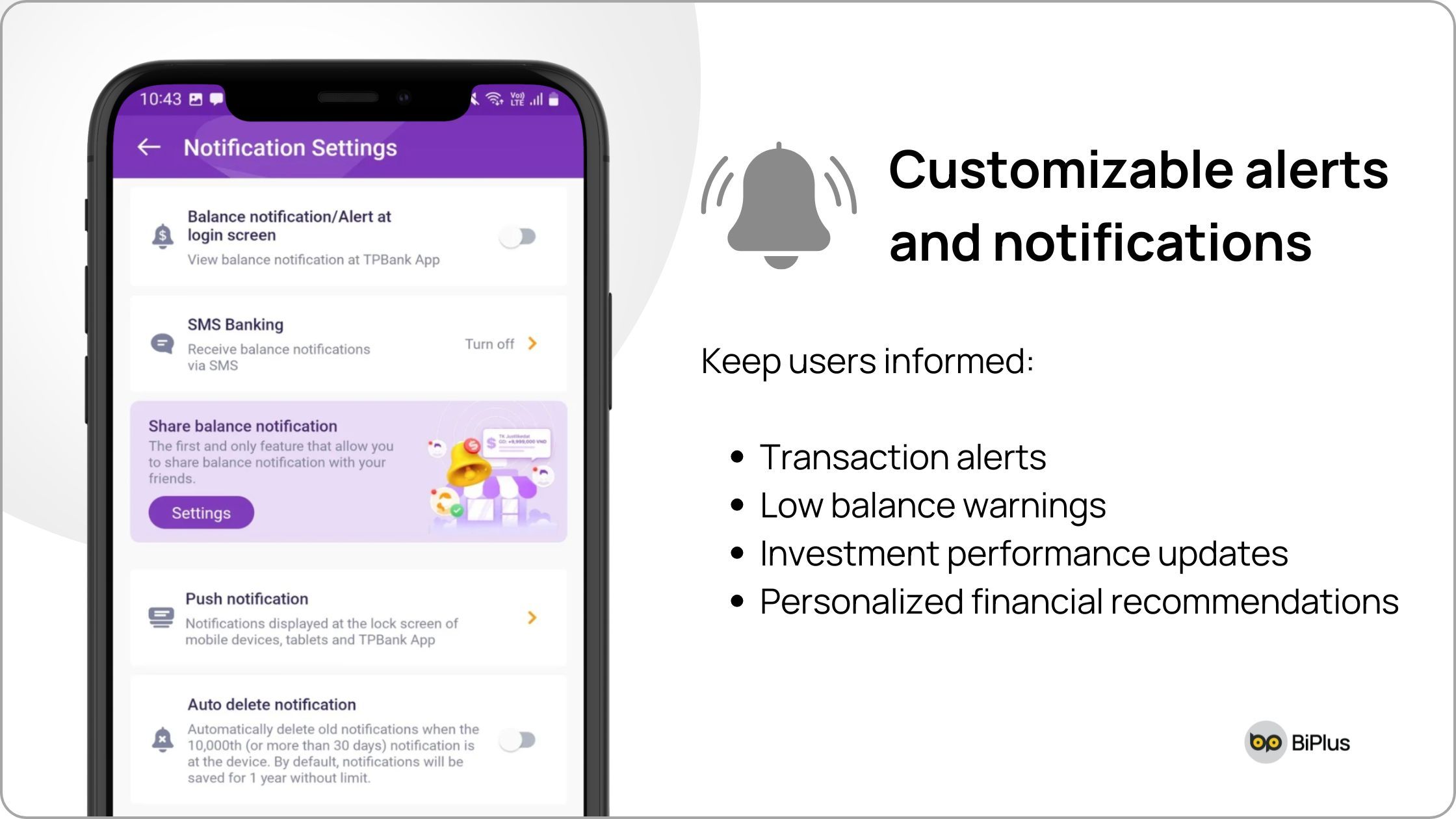

17. Customizable alerts & notifications

18. Dark mode & accessibility

How much does it cost to build a fintech app?

Meet BiPlus: Your fintech app development partner

What is a fintech app?

A fintech app is a mobile or web application that leverages technology to provide innovative financial services. These digital platforms simplify everything from banking and investing to budgeting and payments.

Think of them as your 24/7 financial command center that fits right in your smartphone.

Some popular types of fintech app include:

- Mobile banking apps

- Payment and money transfer apps

- Personal finance and budgeting apps

- Investment apps

- Crowdfunding and fundraising apps

- Blockchain and cryptocurrency apps

- Lending apps (or loan app)

18 must-have features for fintech apps

The success of every fintech app is based on its ability to contribute to the ever-changing needs and trends of the market. An effective fintech app does not only mean an application with aesthetic designs but also a comprehensive and useful tool that support users

By understanding the potential features available, you can tailor your applications to earn the loyalty of your users.

Let's walk through 20 hand-picked must-have features for a fintech app.

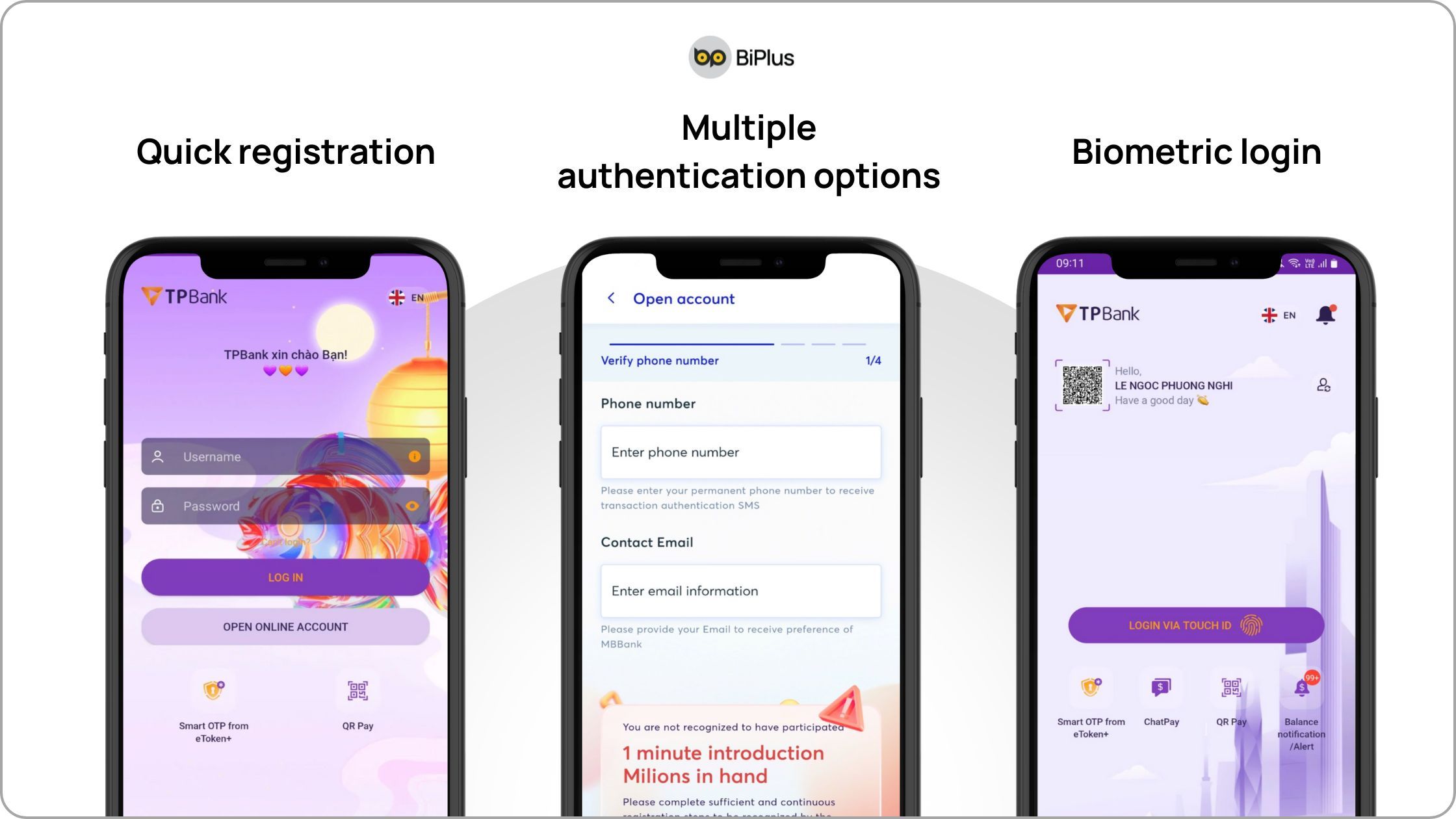

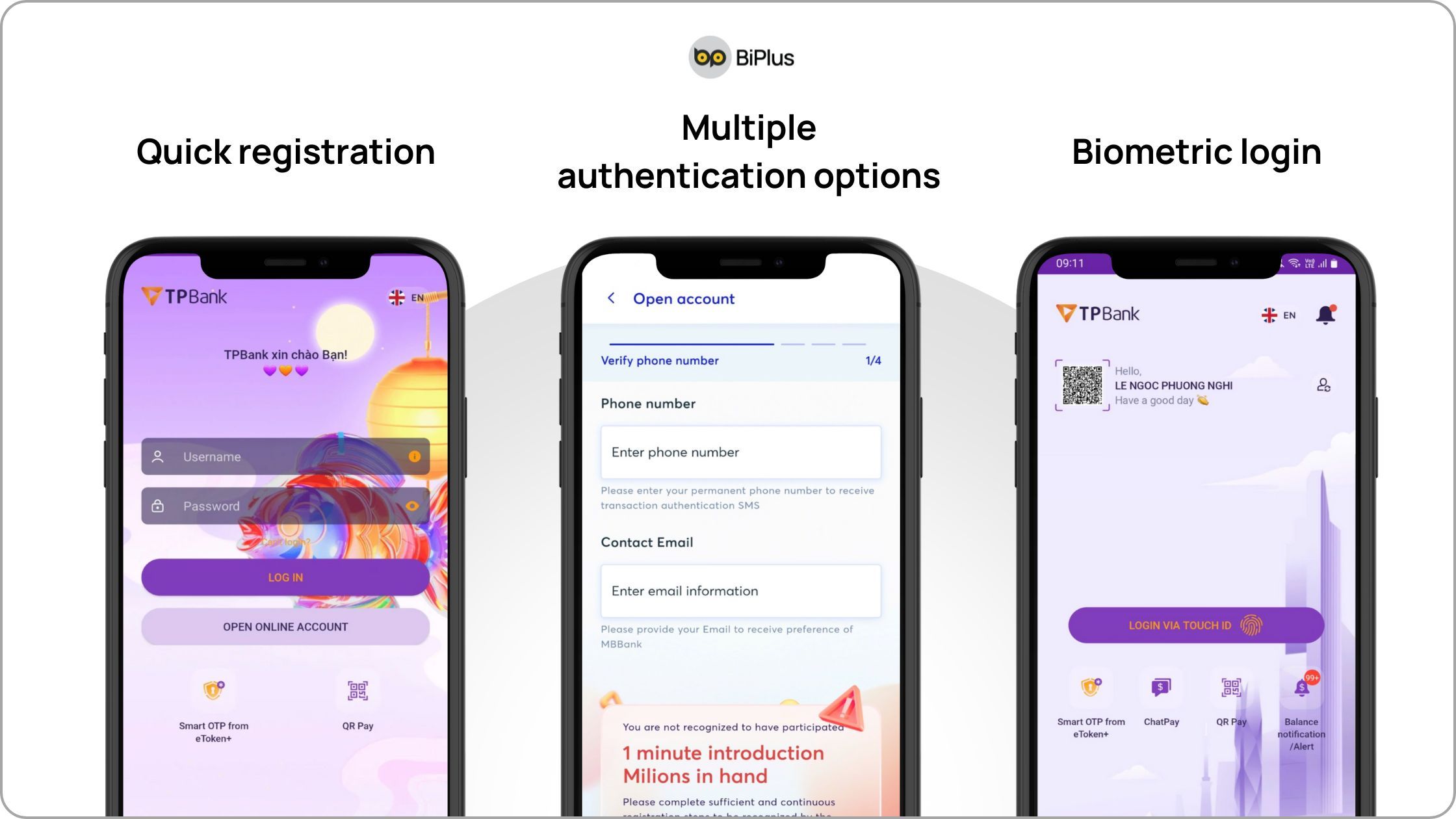

1. Seamless onboarding

Nobody likes complicated signup processes. Your app should offer:

- Quick registration with minimal steps

- Multiple authentication options (email, social media, phone)

- Biometric login (Face ID, fingerprint)

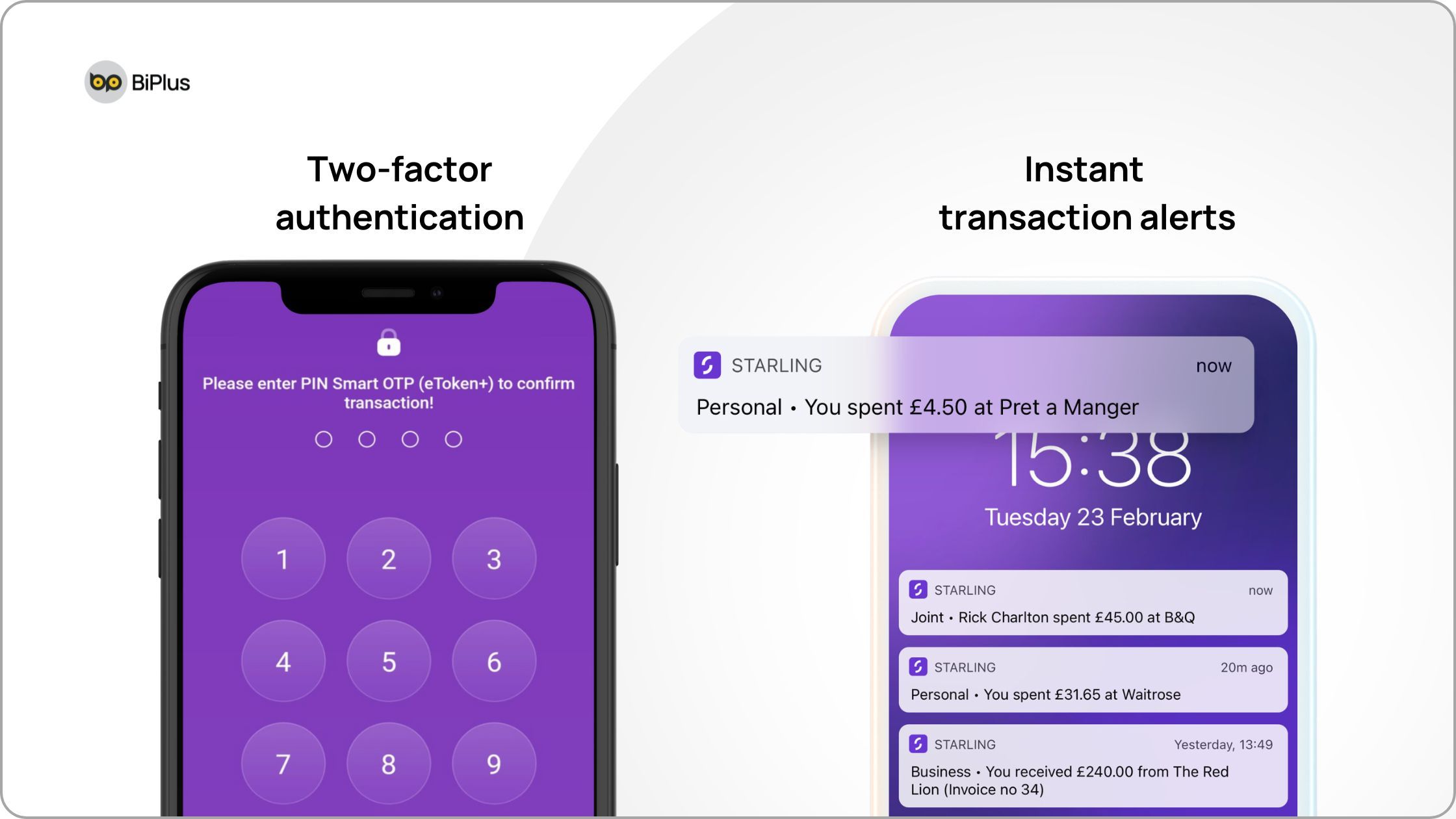

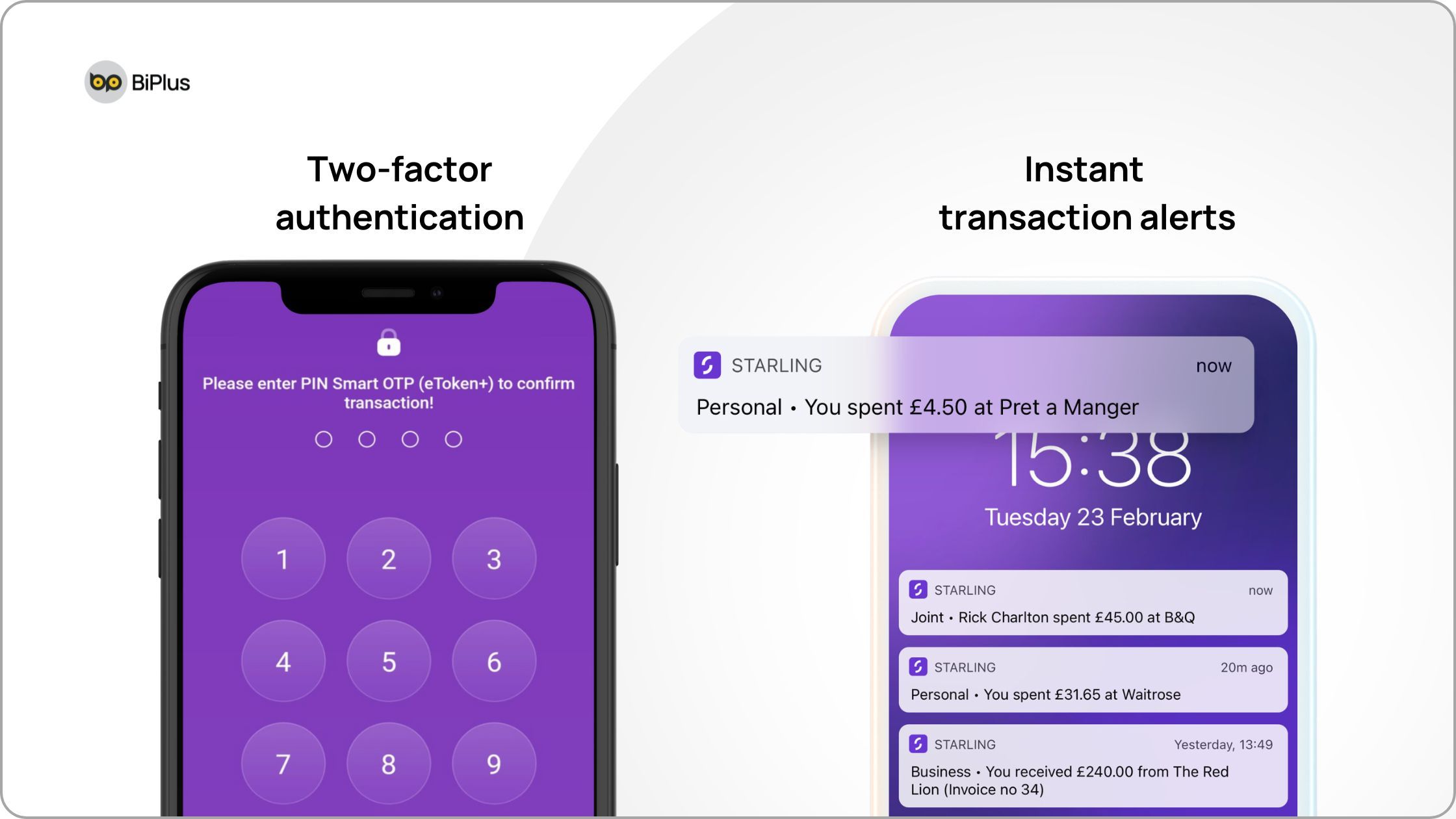

2. Advanced security measures

Trust is currency in financial apps. Essential security features include:

- End-to-end encryption

- Two-factor authentication

- Real-time fraud detection

- Instant transaction alerts

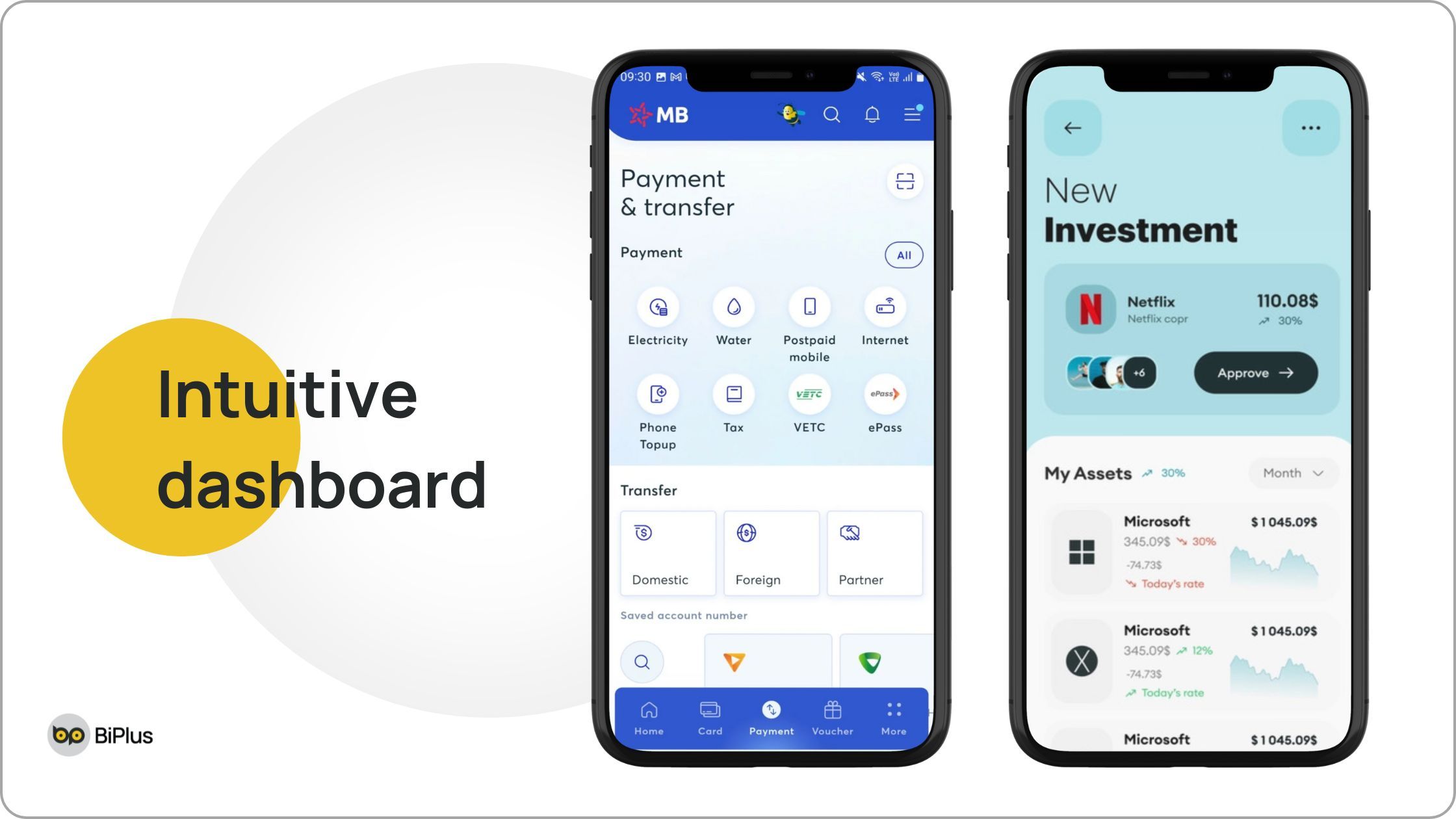

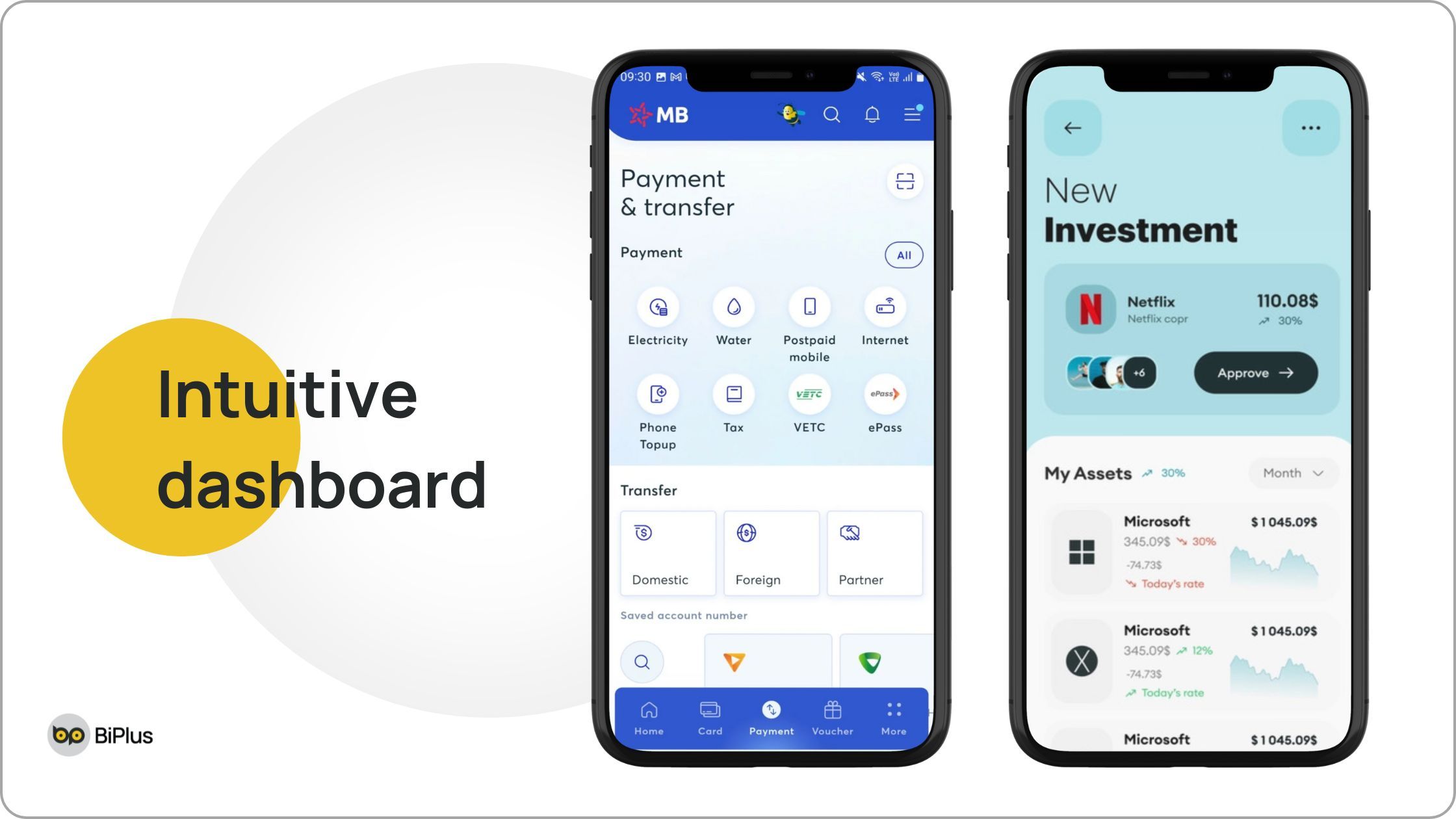

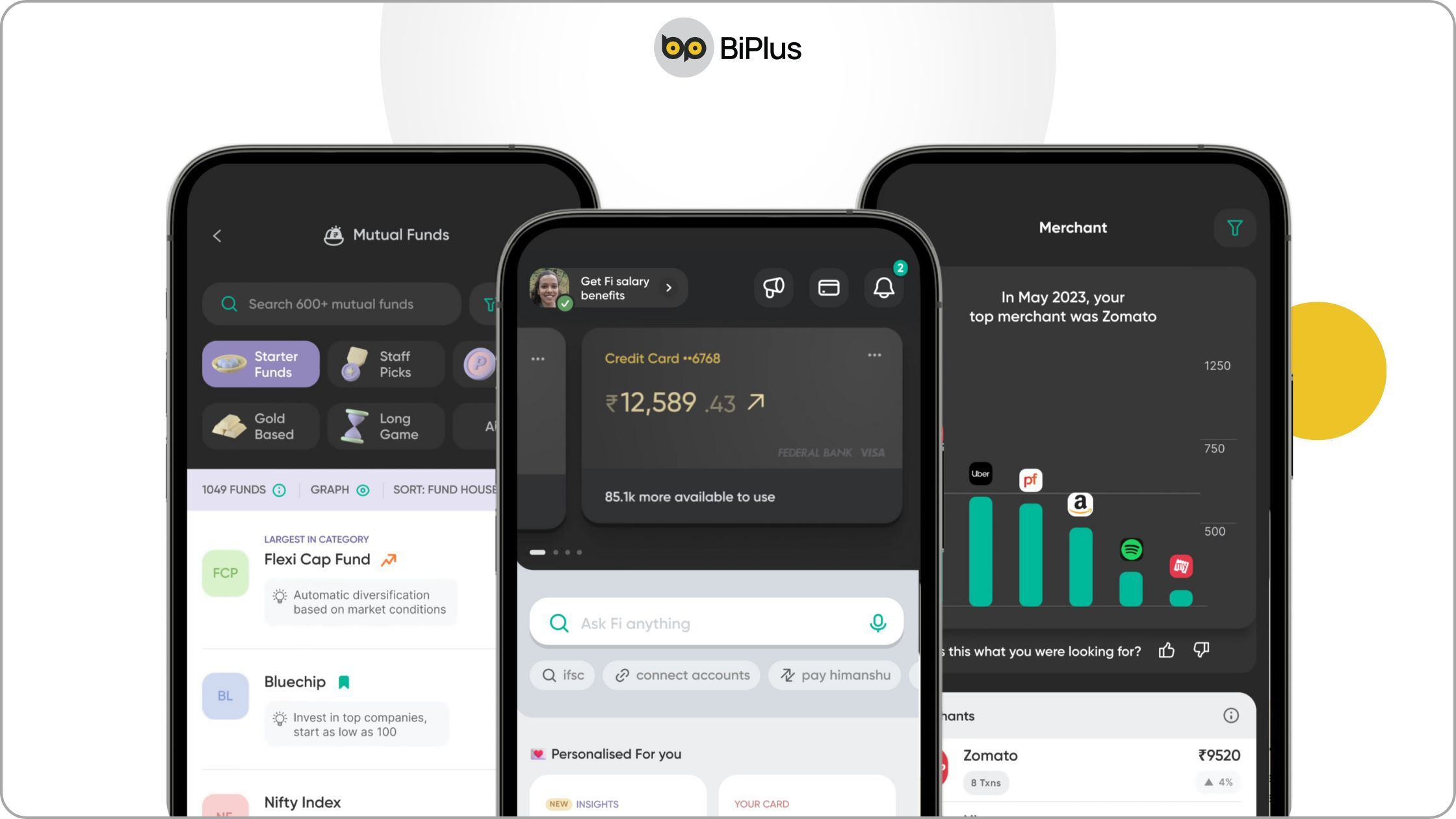

3. Intuitive dashboard

Your app's dashboard should be:

- Clean and uncluttered

- Personalized financial overview

- Easy-to-read graphs and charts

- Quick access to key financial metrics

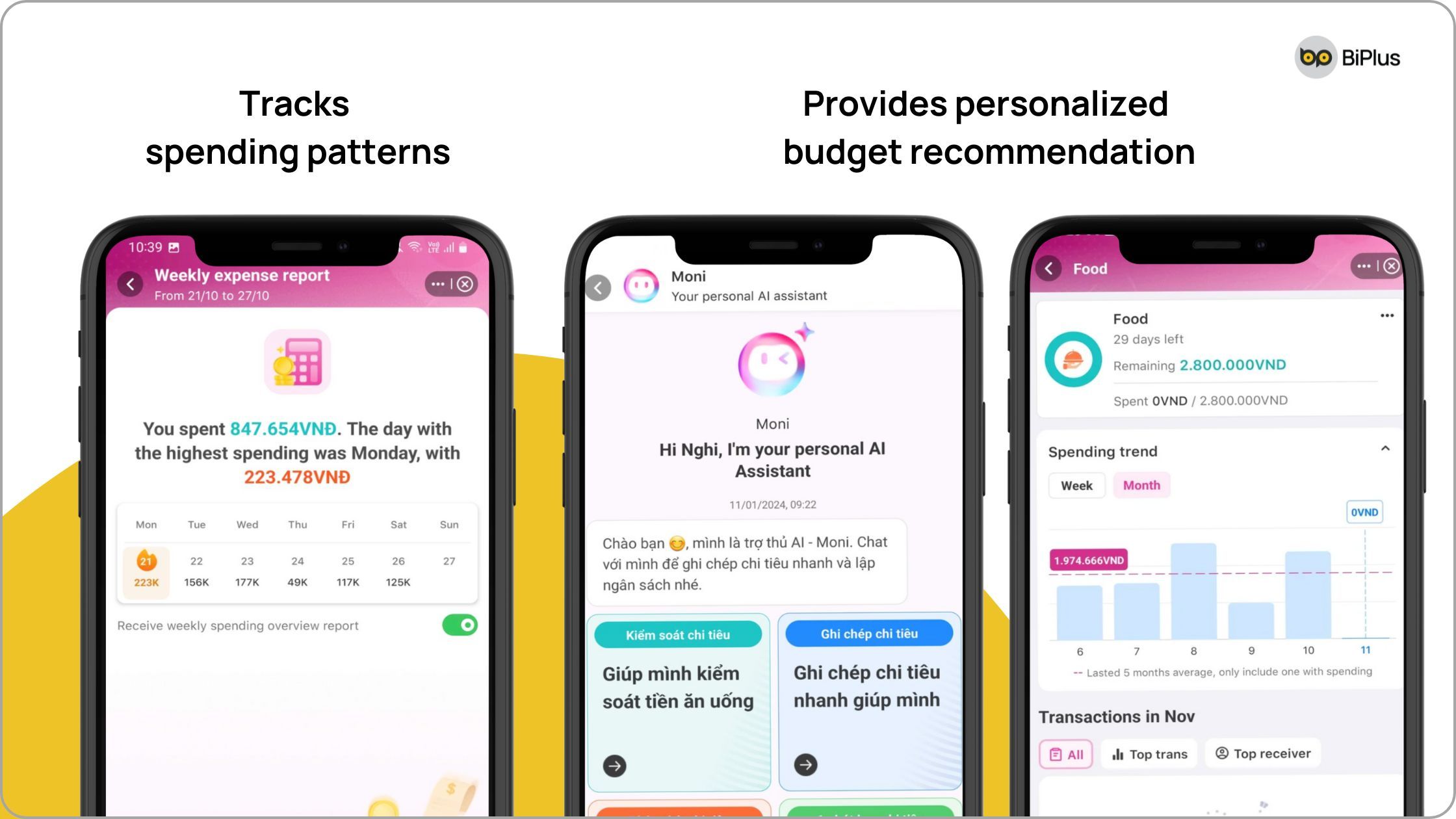

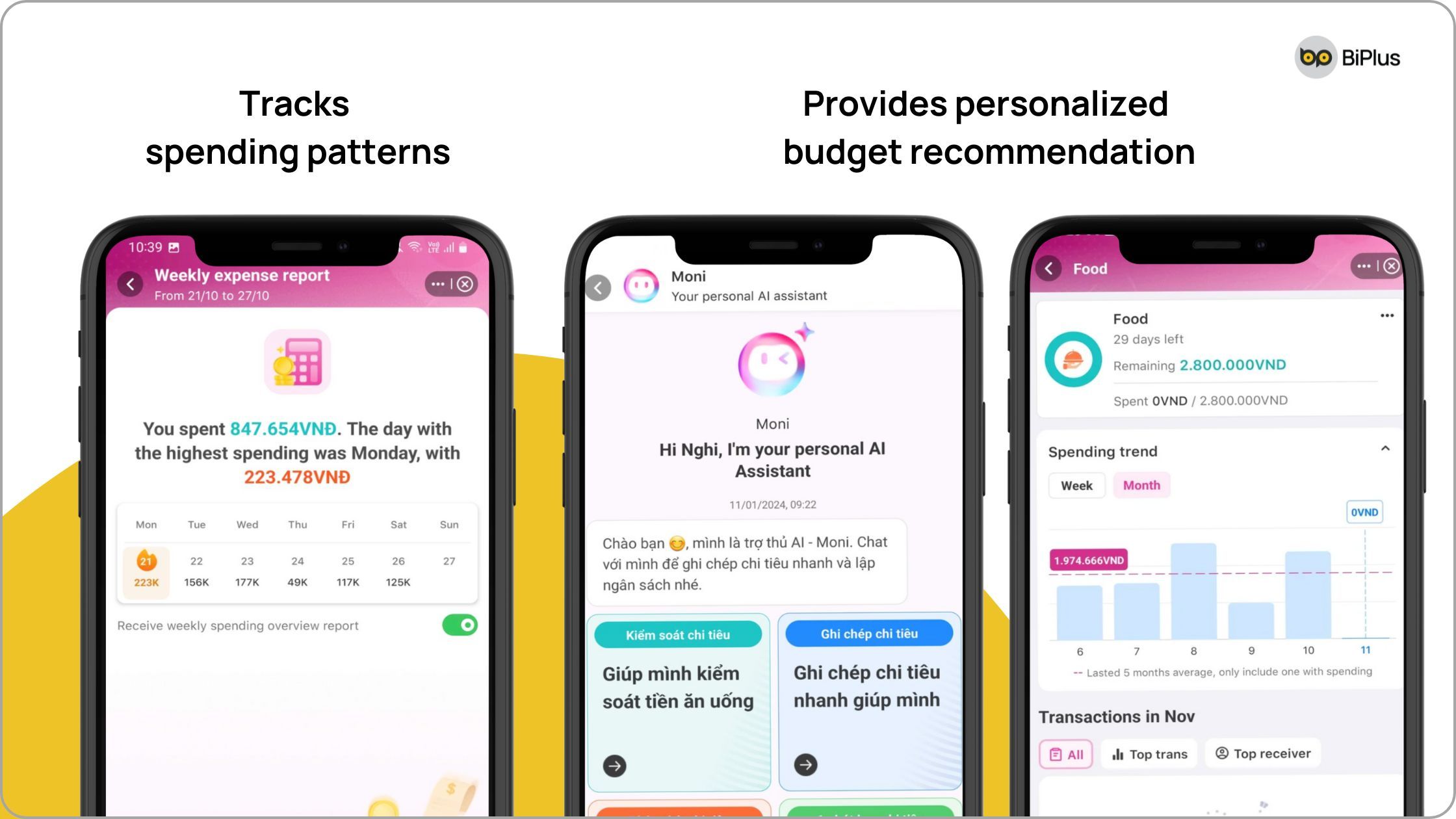

4. AI-powered financial insights

Integrate intelligent analysis that:

- Tracks spending patterns

- Provides personalized budget recommendations

- Predicts potential financial risks

- Suggests savings opportunities

5. Multi-account integration

Allow users to:

- Connect multiple bank accounts

- View consolidated financial statements

- Transfer funds between accounts seamlessly

- Track investments across platforms

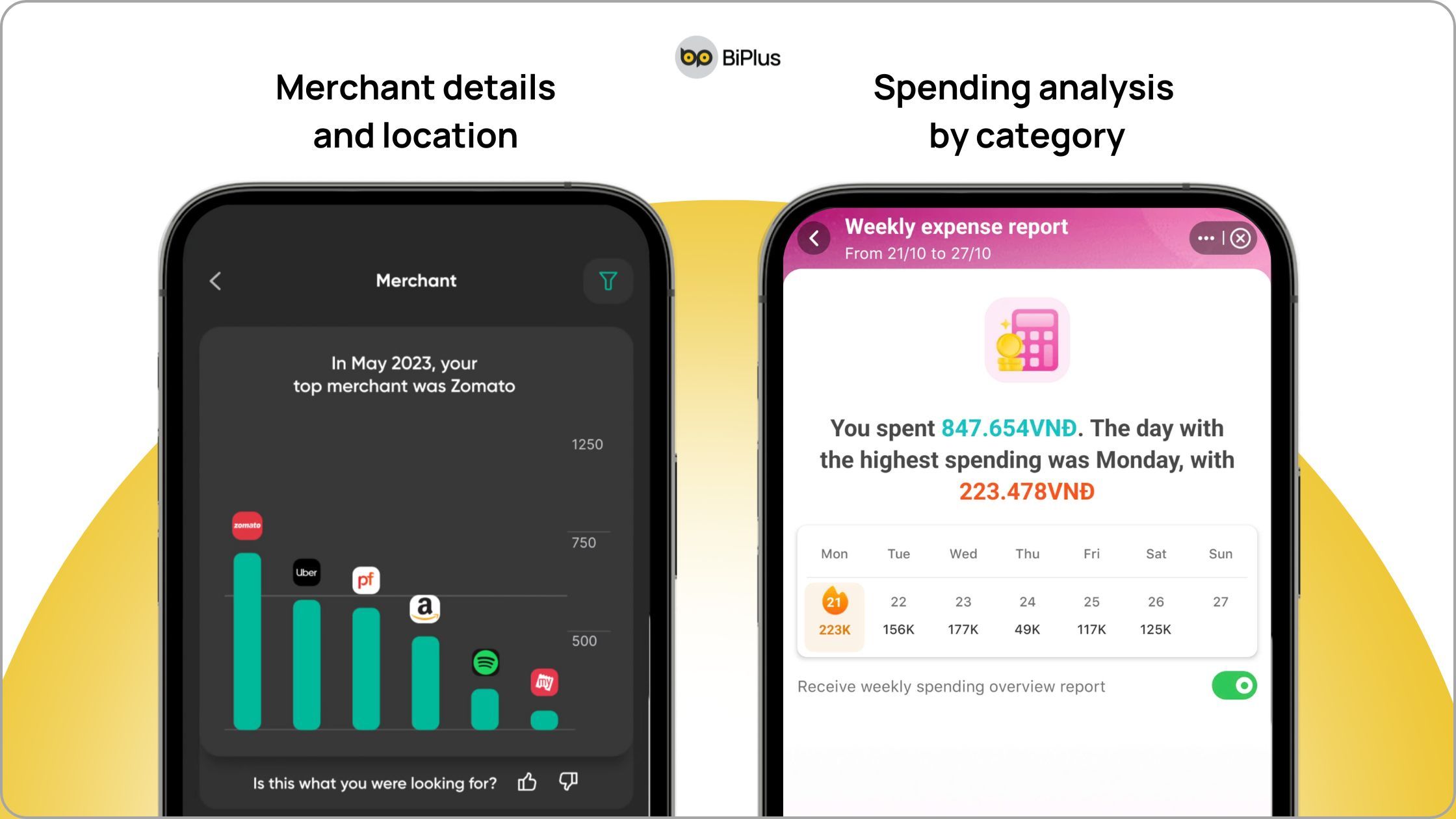

6. Real-time transaction tracking

Offer comprehensive transaction management:

- Instant transaction notifications

- Categorized expense tracking

- Merchant details and location

- Spending analysis by category

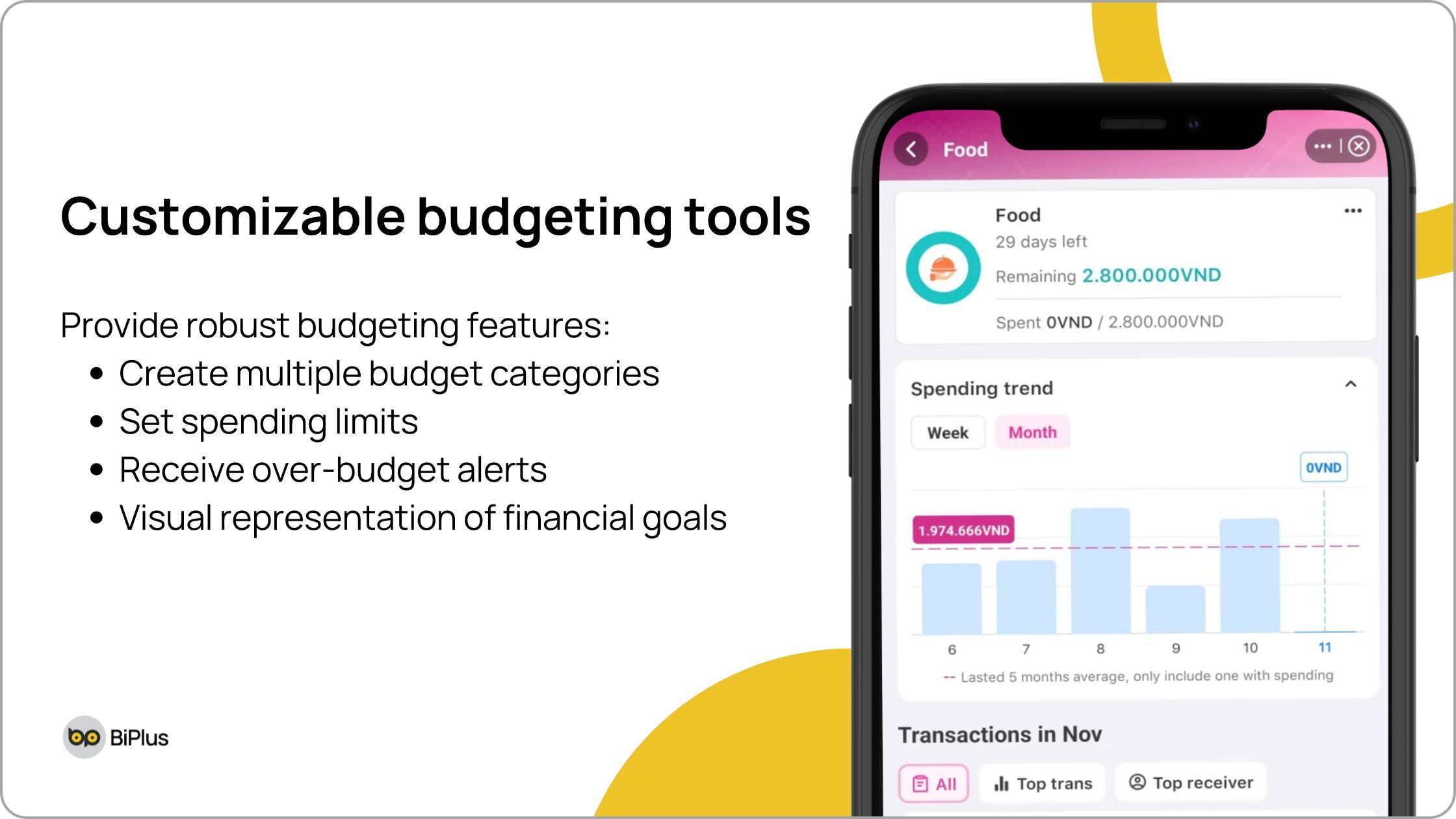

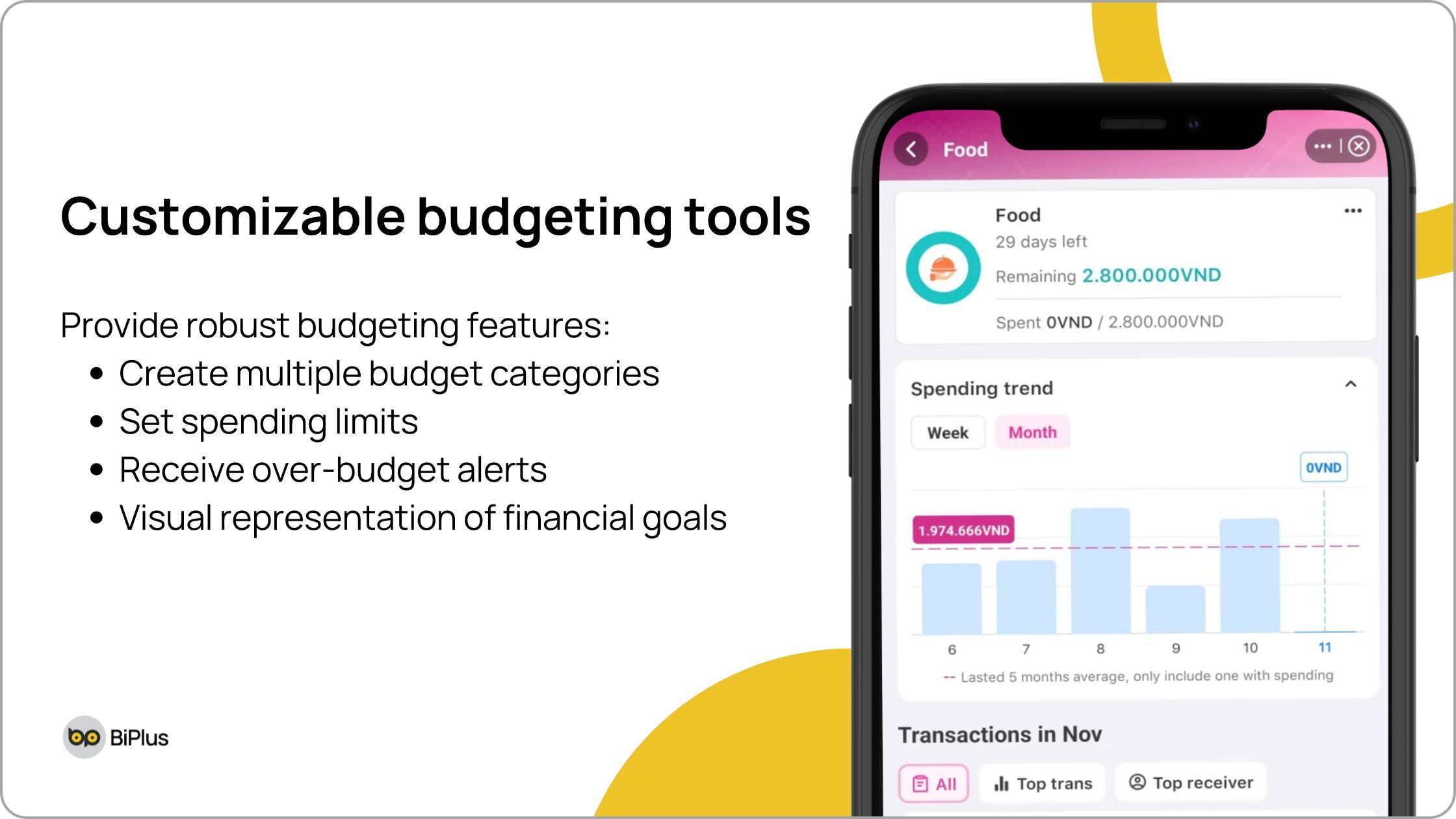

7. Customizable budgeting tools

Provide robust budgeting features:

- Create multiple budget categories

- Set spending limits

- Receive over-budget alerts

- Visual representation of financial goals

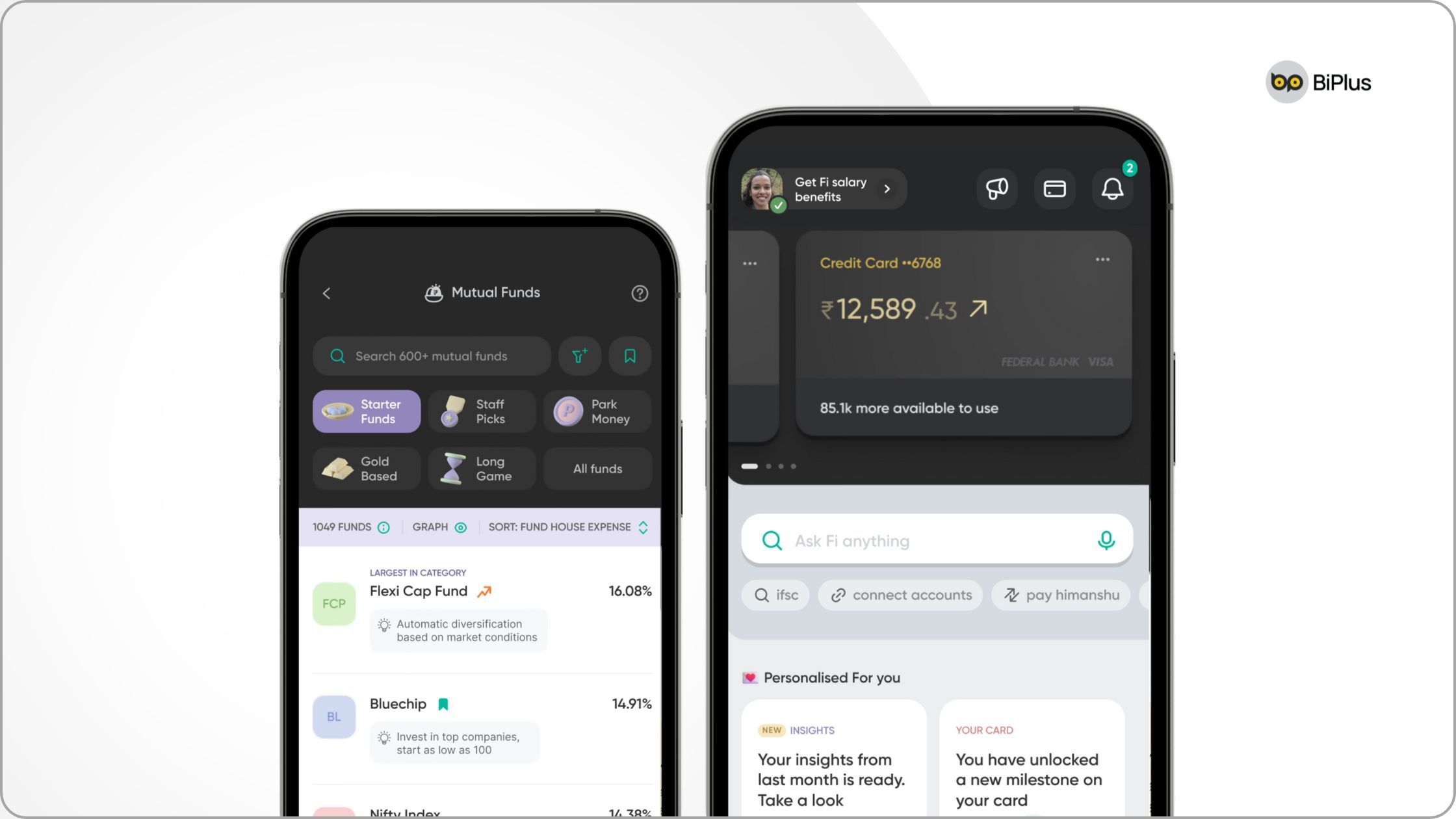

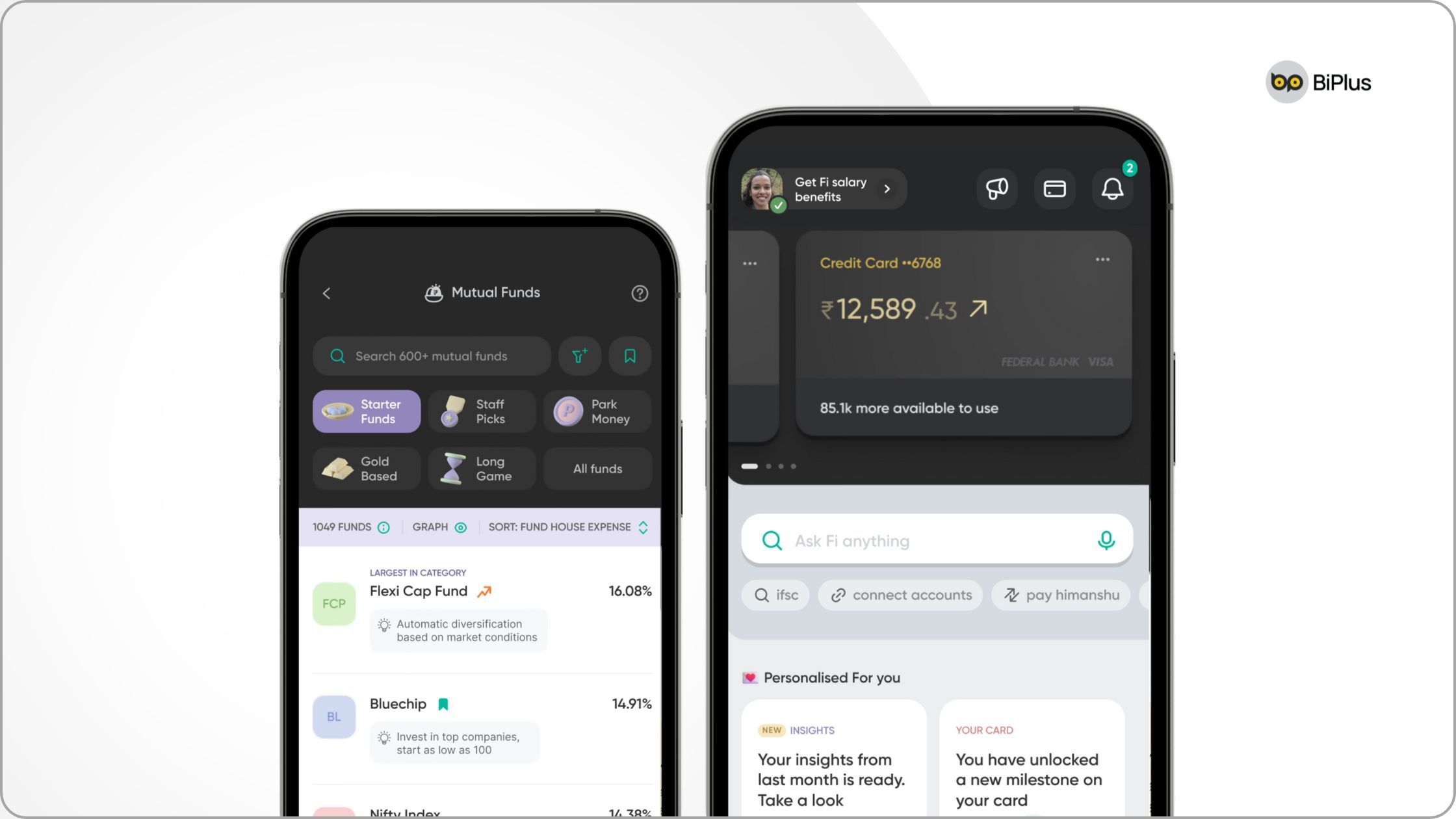

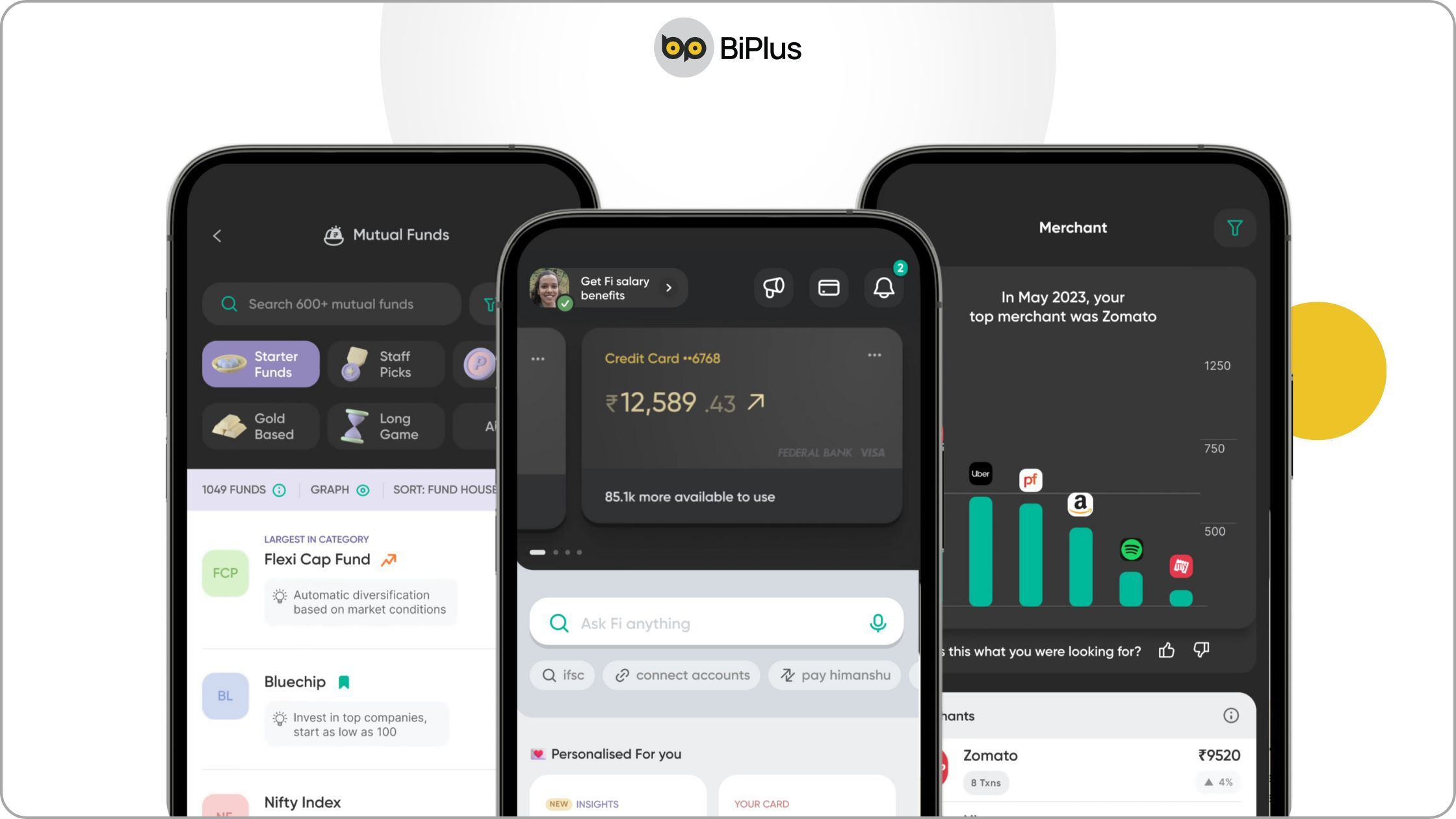

8. Investment tracking & guidance

For investment-focused users:

- Portfolio performance tracking

- Real-time market data

- Investment recommendations

- Risk assessment tools

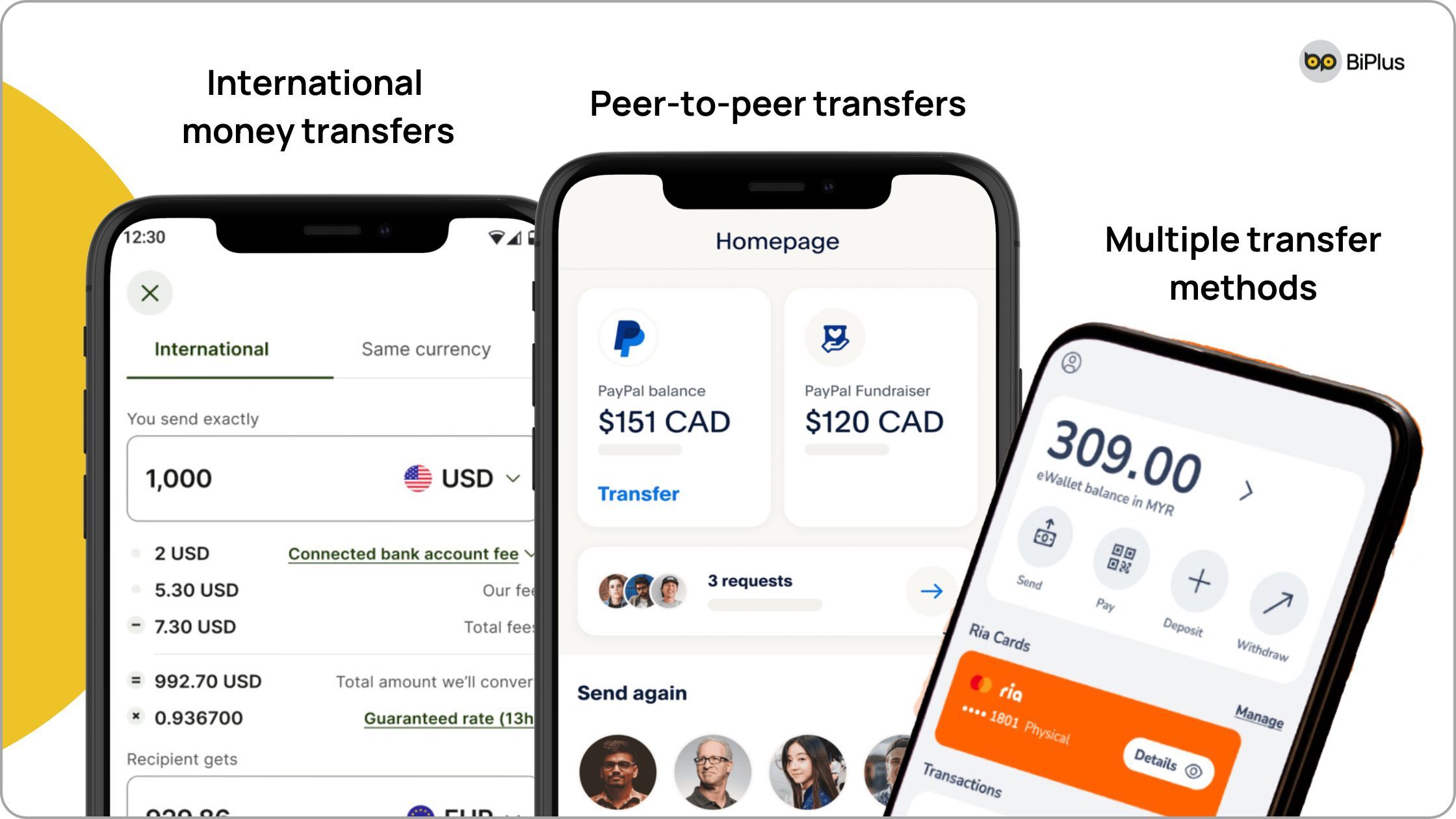

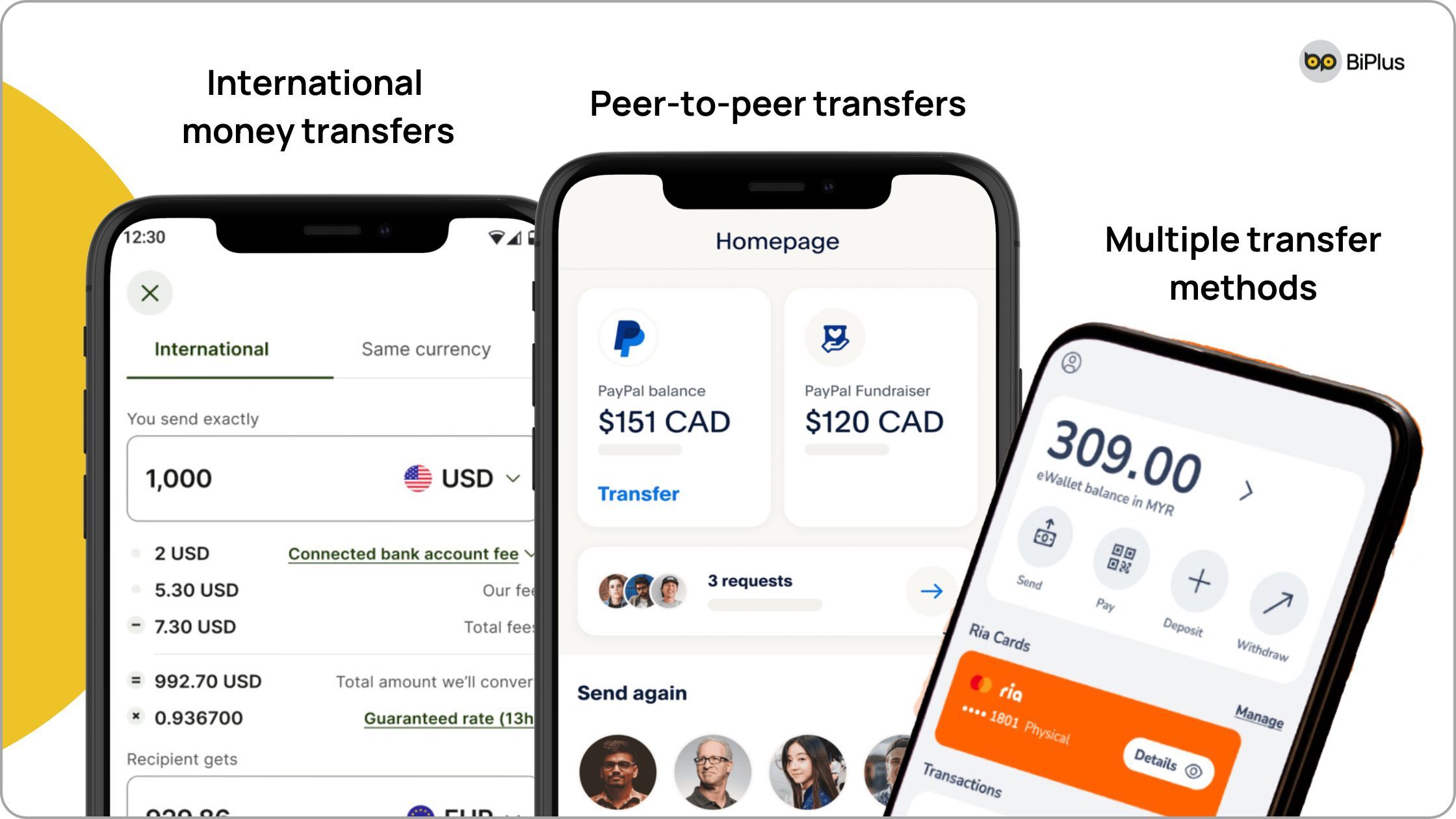

9. Instant money transfer

Enable quick and secure transfers:

- Peer-to-peer transfers

- International money transfers

- Low transaction fees

- Multiple transfer methods

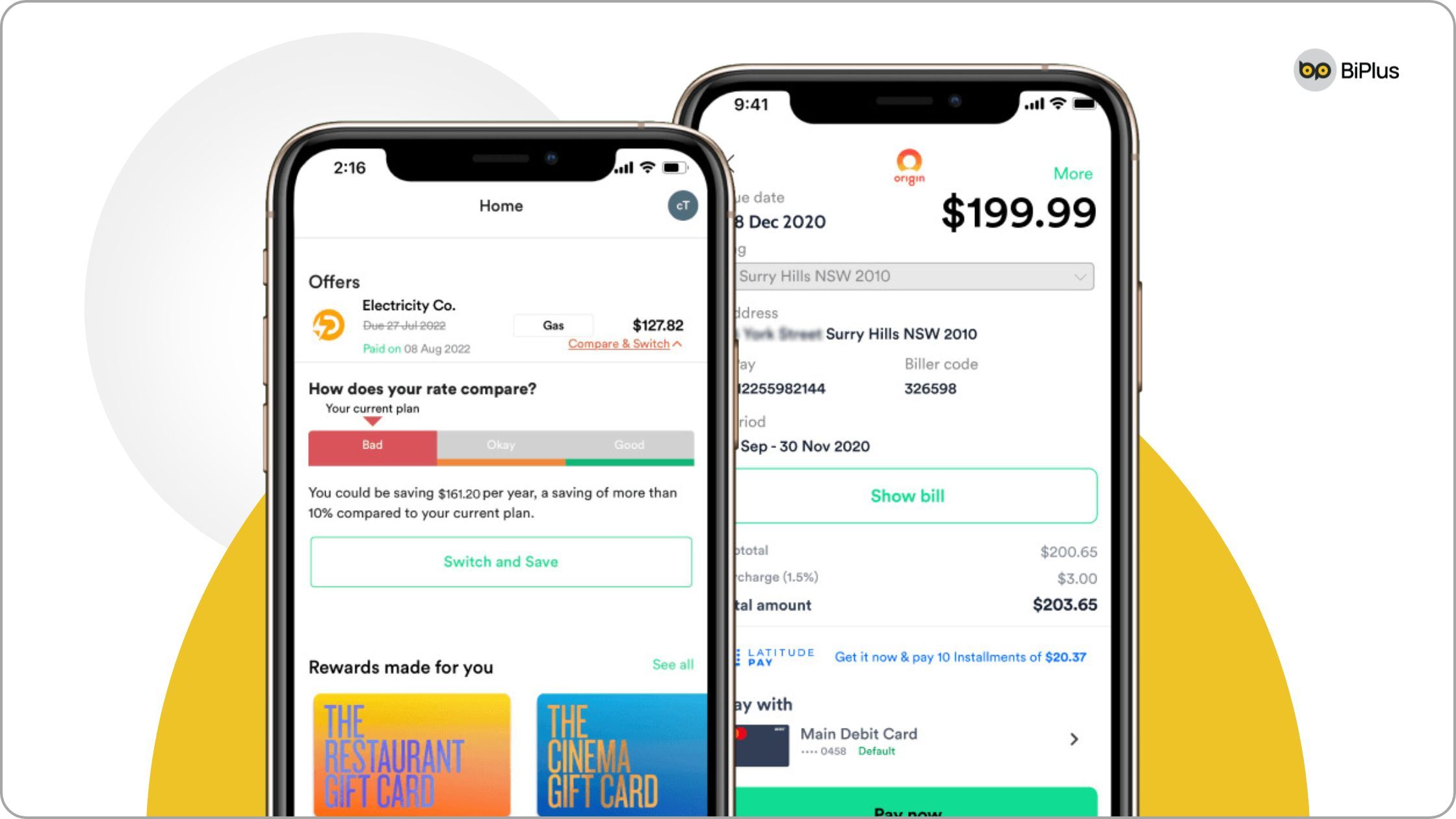

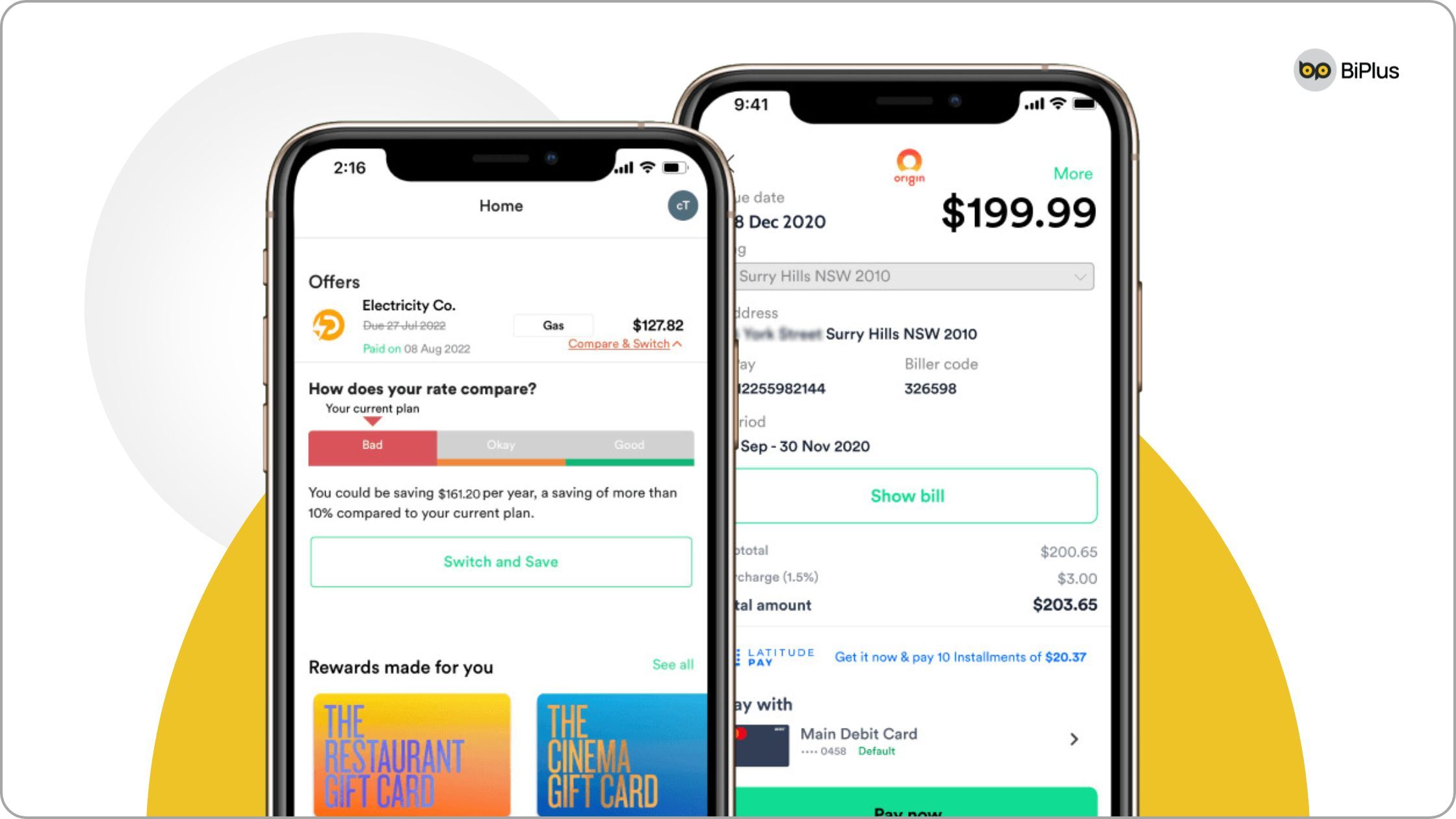

10. Bill payment & management

Streamline bill management:

- Centralized bill tracking

- Automatic payment scheduling

- Bill split functionality

- Payment reminders

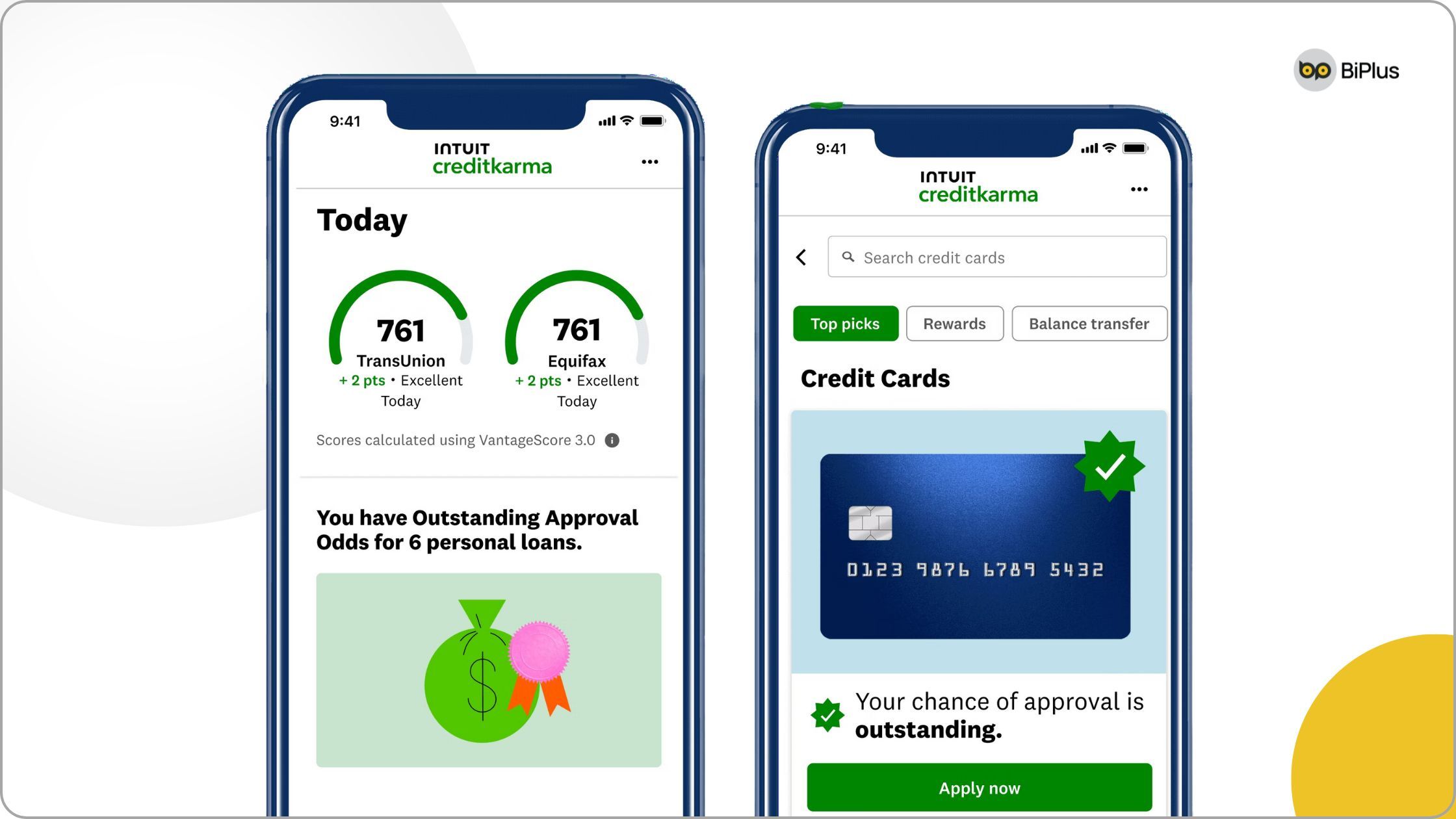

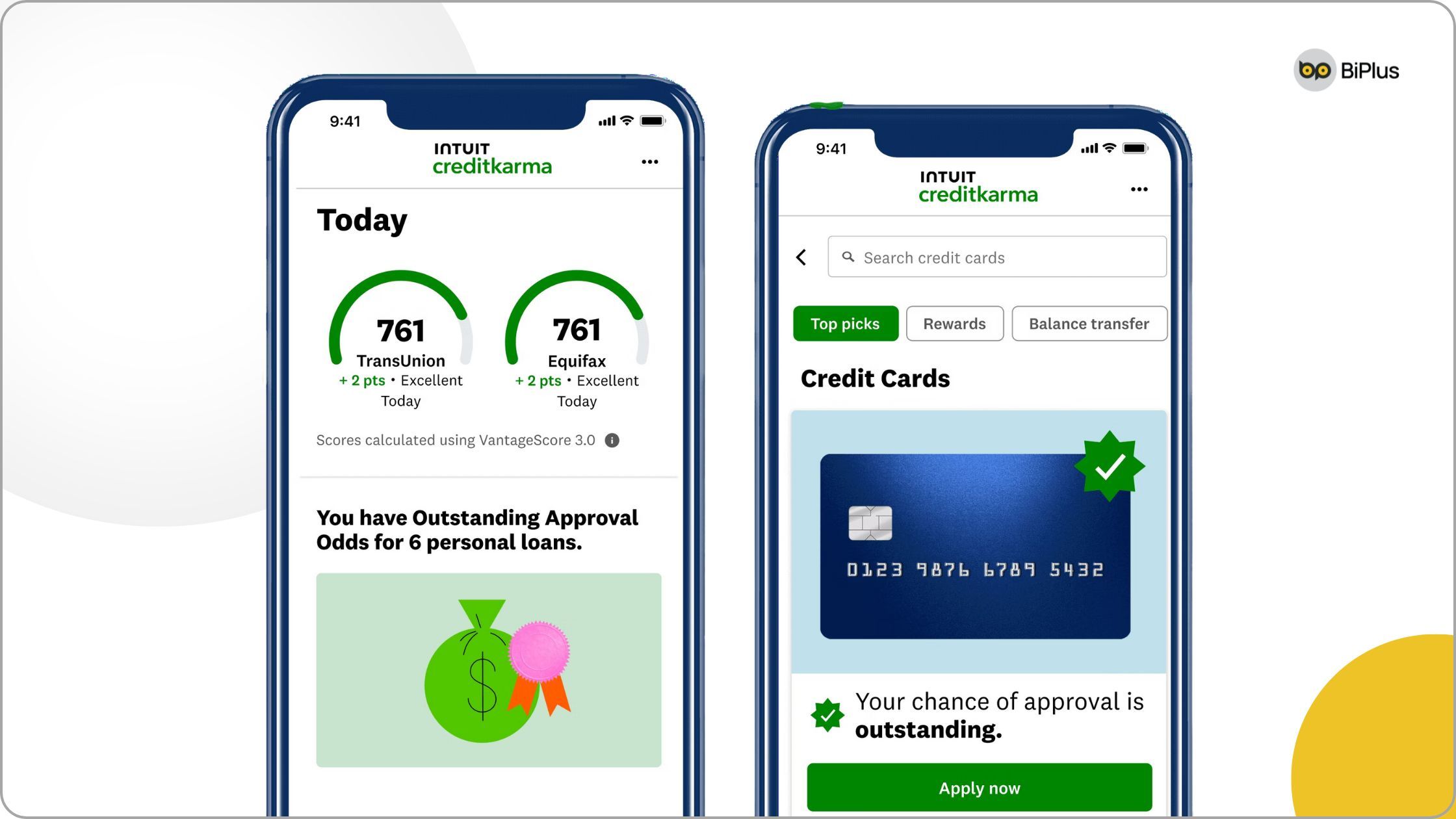

11. Credit score monitoring

Integrate comprehensive credit insights:

- Free credit score checks

- Credit health recommendations

- Personalized improvement tips

- Credit report analysis

12. Savings & investment automation

Make saving effortless:

- Automatic savings rules

- Round-up investment features

- Goal-based saving plans

- Micro-investment options

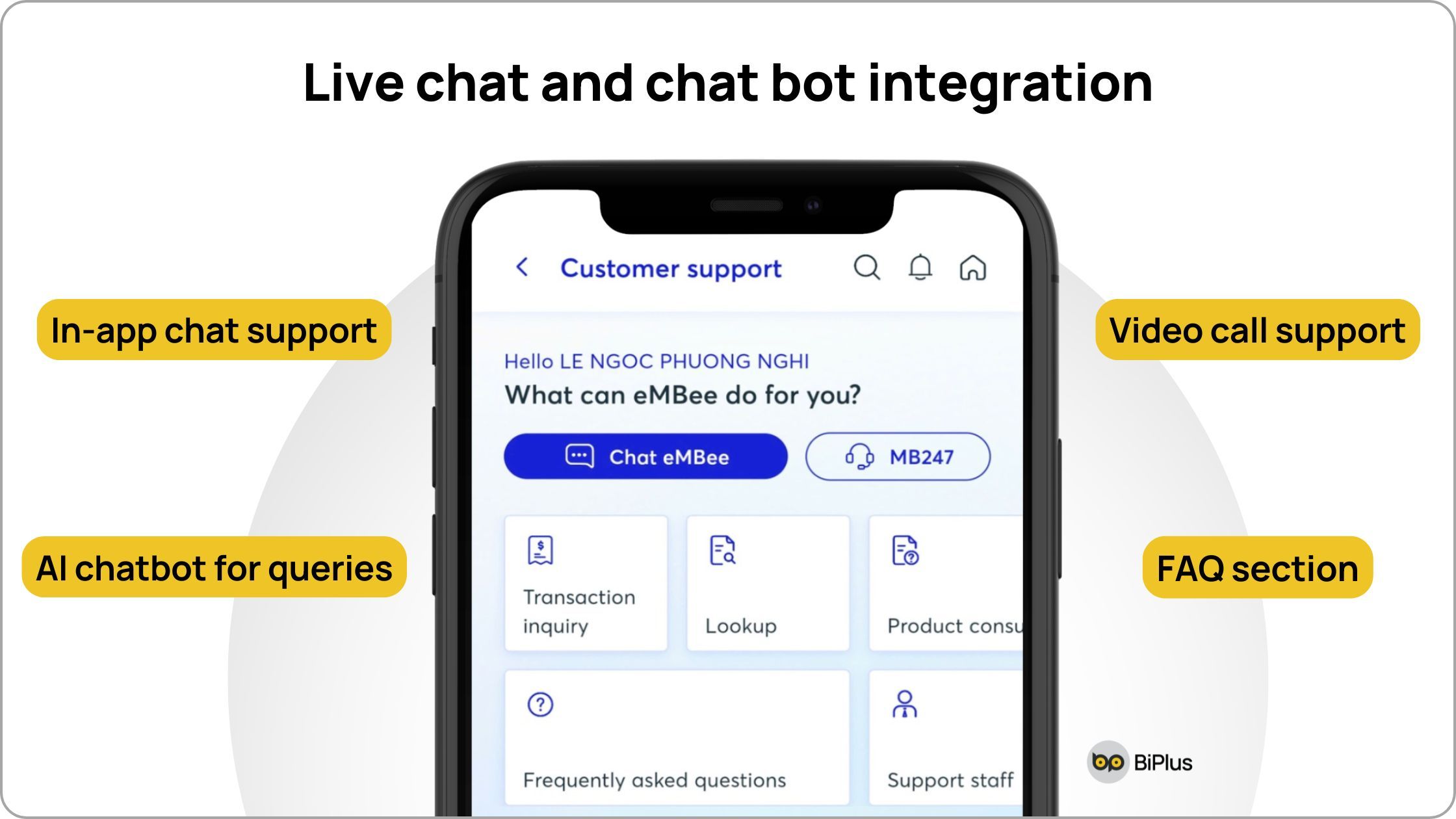

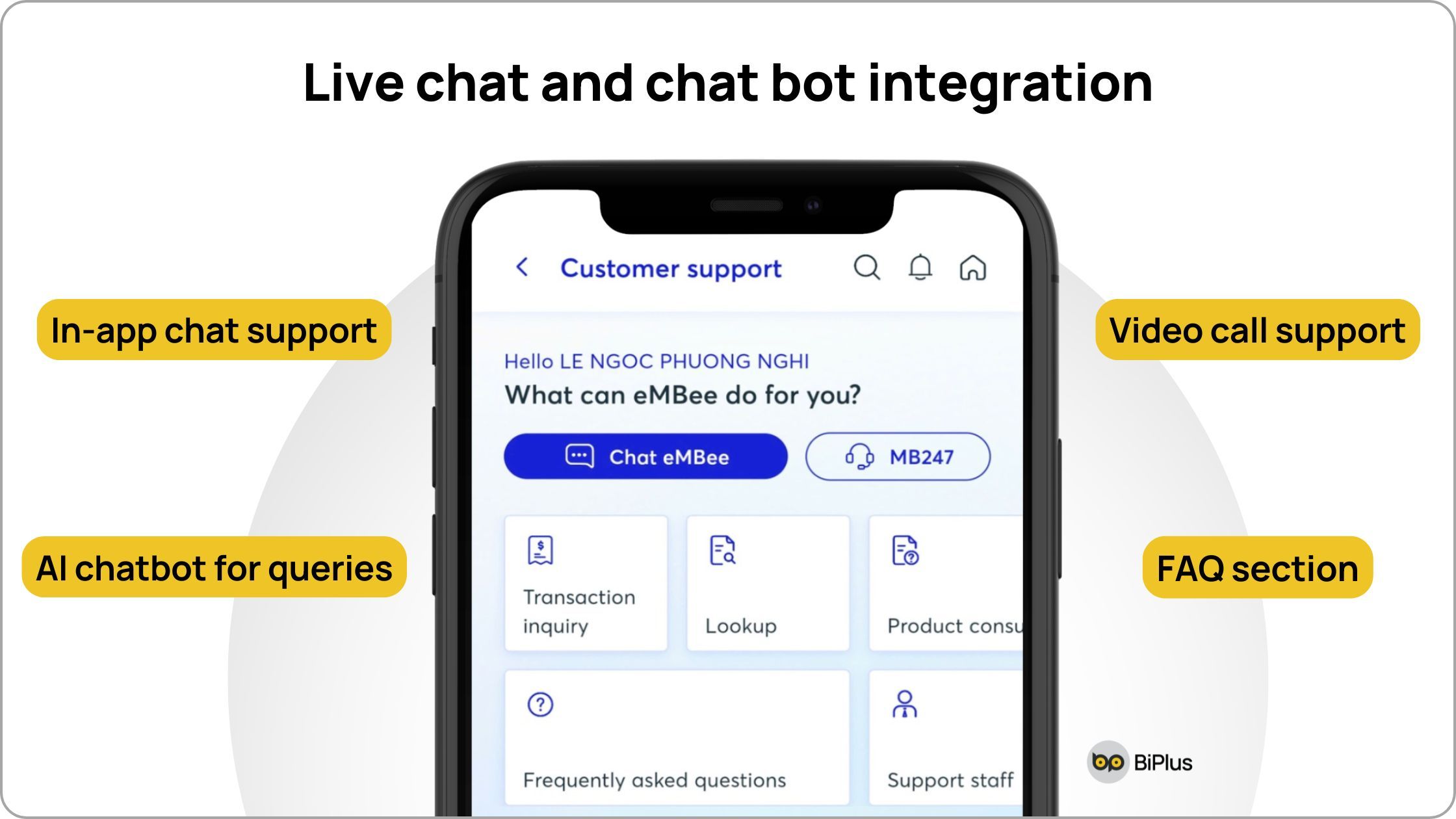

13. Live chat and chat bot integration

Provide multiple support channels:

- In-app chat support

- AI chatbot for quick queries

- Video call support

- Comprehensive FAQ section

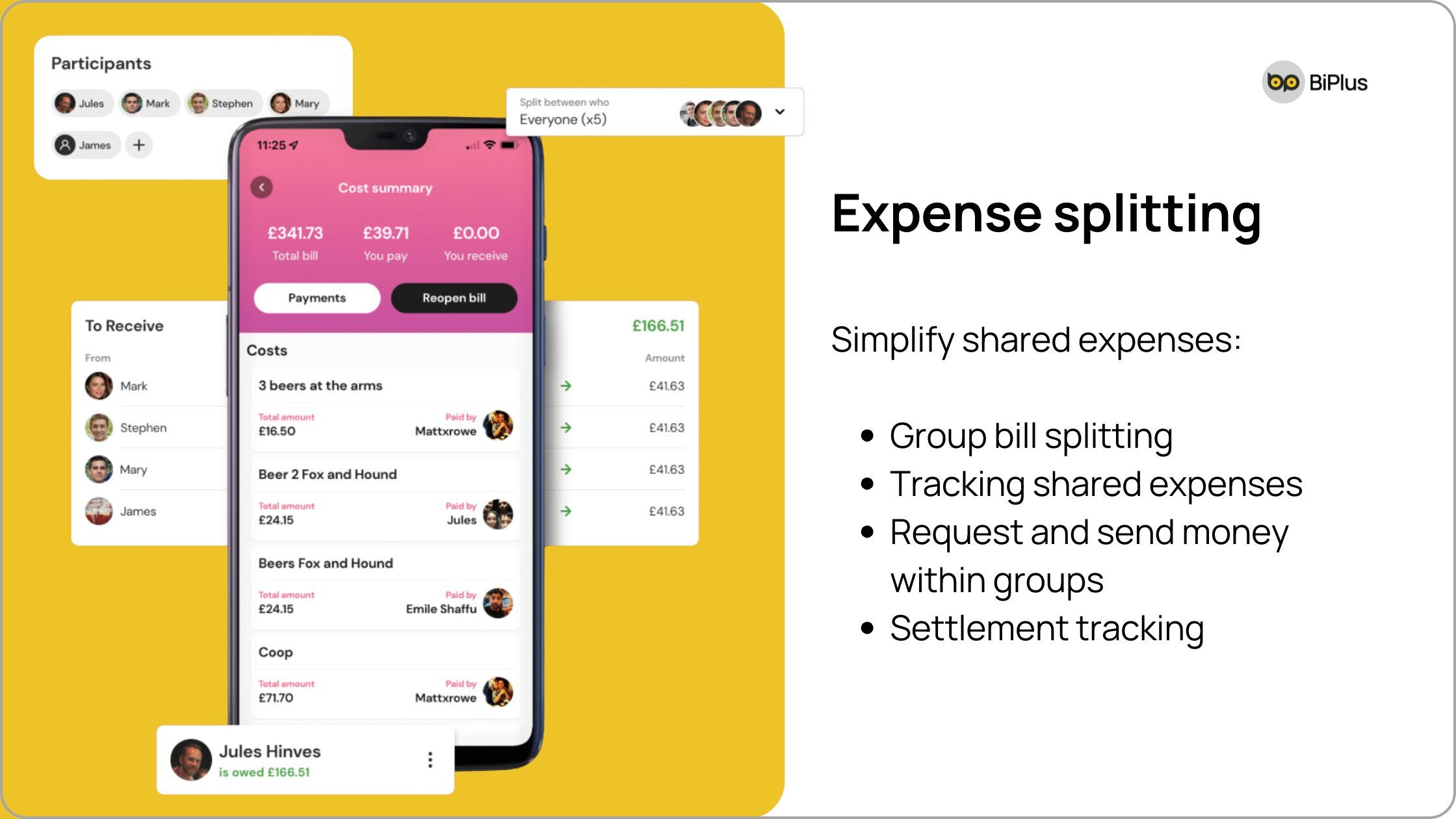

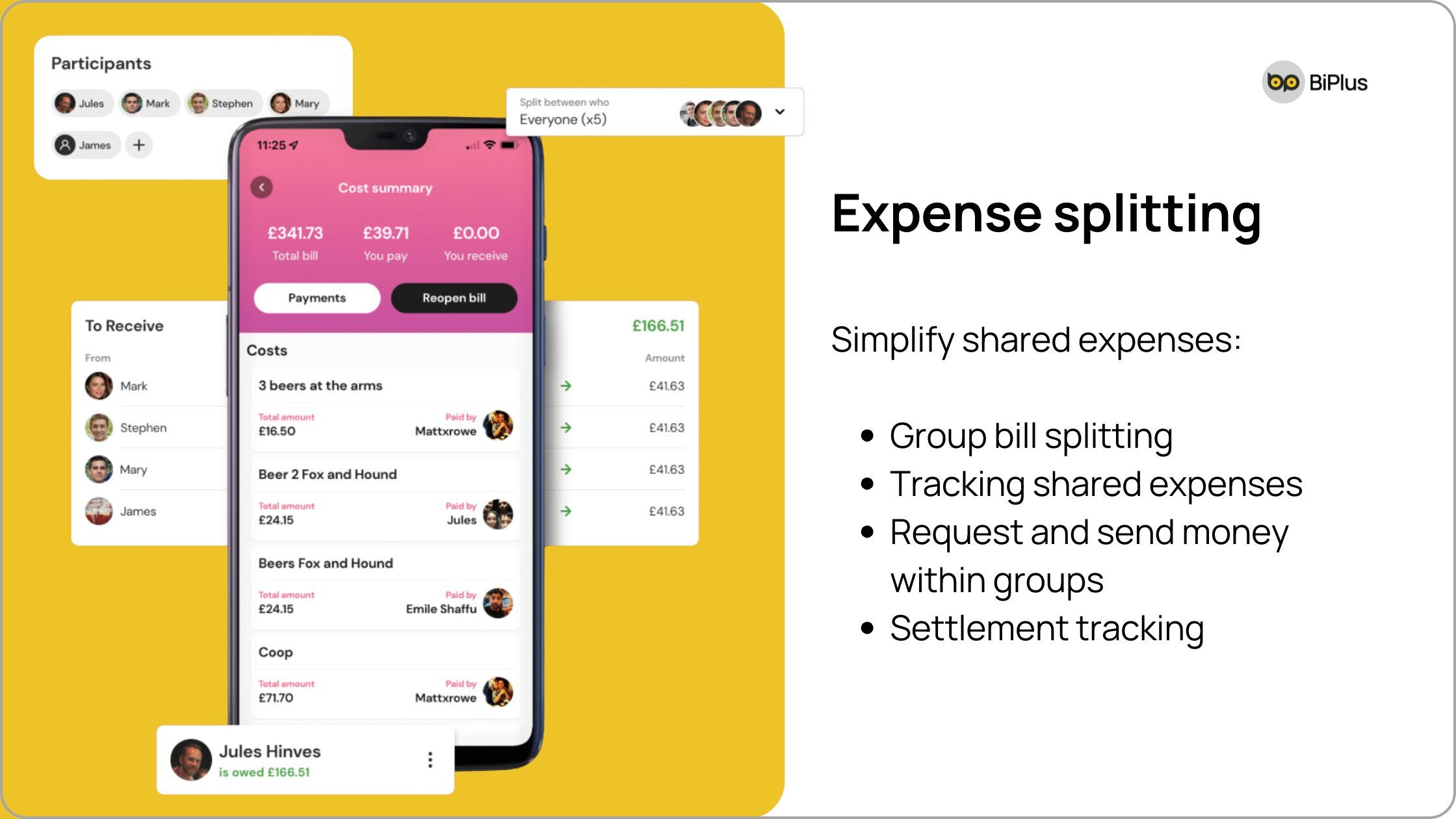

14. Expense splitting

Simplify shared expenses:

- Group bill splitting

- Tracking shared expenses

- Request and send money within groups

- Settlement tracking

15. Receipt & document management

Create a digital financial archive:

- Receipt scanning and storage

- Tax document organization

- Export financial reports

- Cloud synchronization

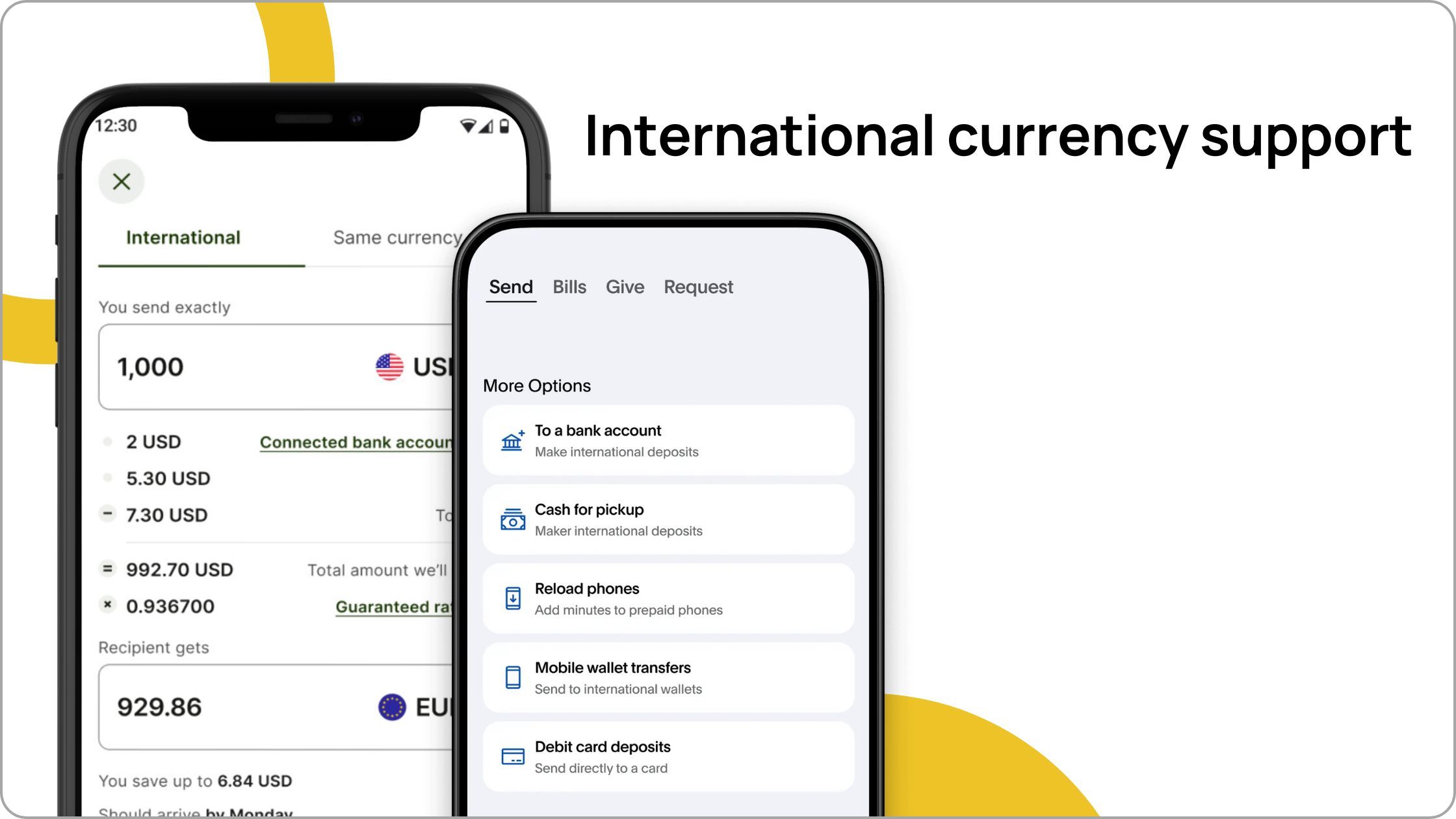

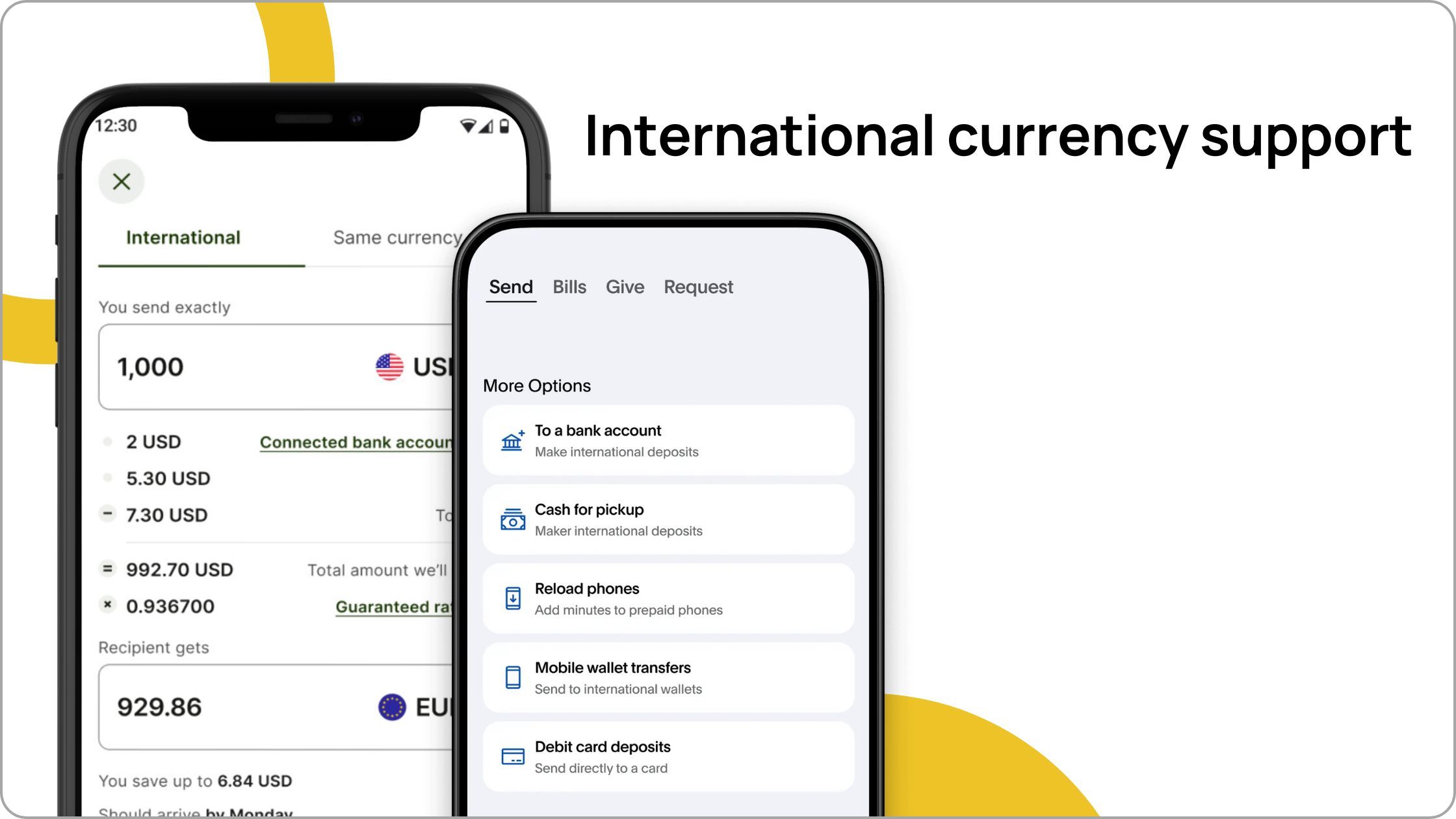

16. International currency support

For global users:

- Multi-currency accounts

- Real-time currency conversion

- Low-fee international transactions

- Currency rate tracking

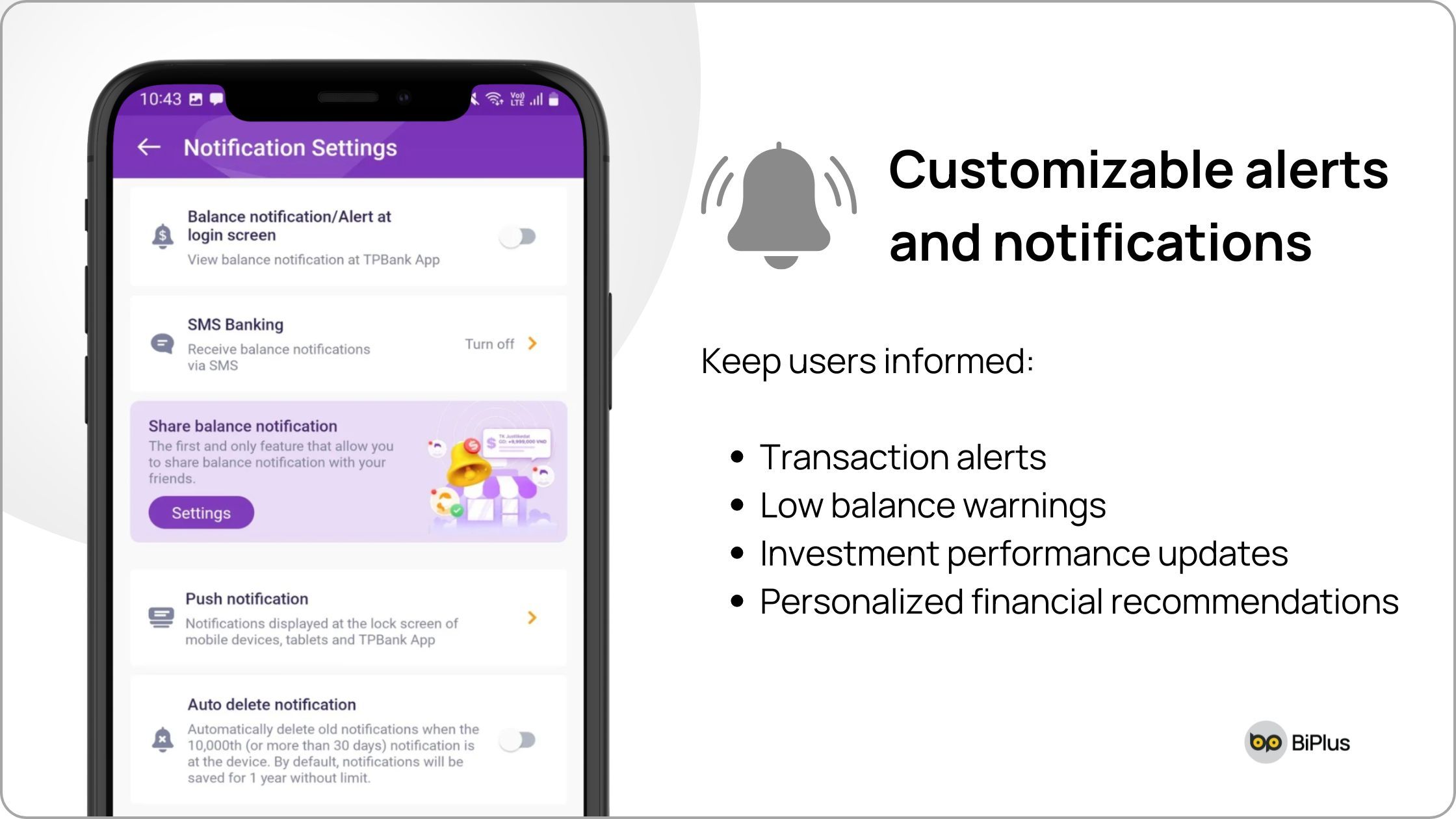

17. Customizable alerts & notifications

Keep users informed:

- Transaction alerts

- Low balance warnings

- Investment performance updates

- Personalized financial recommendations

18. Dark mode & accessibility

Enhance user experience:

- Dark/light mode toggle

- Screen reader compatibility

- Adjustable text sizes

- Color-blind friendly design

How much does it cost to build a fintech app?

Building a fintech app involves multiple factors that influence the overall development cost.

It depends on complexity, features, and development approach.

Here's a breakdown to help you understand the investment required.

Estimated cost to build a fintech app

| Development Stage | App With Basic Features | App With Advanced Features | App With Complex Features |

|---|

Planning & Design | $5,000 - $10,000 | $10,000 - $20,000 | $20,000 - $35,000 |

Core Development | $30,000 - $50,000 | $50,000 - $100,000 | $100,000 - $200,000 |

Feature Integration | $10,000 - $20,000 | $20,000 - $50,000 | $50,000 - $100,000 |

Security Implementation | $5,000 - $10,000 | $10,000 - $25,000 | $25,000 - $50,000 |

Third-Party Integrations | $5,000 - $15,000 | $15,000 - $30,000 | $30,000 - $60,000 |

Testing & Quality Assurance | $5,000 - $10,000 | $10,000 - $20,000 | $20,000 - $40,000 |

Deployment & Initial Support | $5,000 - $10,000 | $10,000 - $20,000 | $20,000 - $35,000 |

Total Estimated Cost | $65,000 - $125,000 | $125,000 - $265,000 | $265,000 - $520,000 |

Basic Fintech App ($65,000 - $125,000)

- Limited features

- Simple user interface

- Basic security measures

- Minimal third-party integrations

Medium Complexity App ($125,000 - $265,000)

- More advanced features

- Complex security protocols

- Multiple payment integrations

- Moderate AI and personalization

Advanced Fintech App ($265,000 - $520,000)

- Full-featured enterprise-level solution

- Advanced AI and machine learning

- Comprehensive security systems

- Multiple platform support (iOS, Android, Web)

- Advanced analytics and reporting

Cost-Saving Tips

- Start with a Minimum Viable Product (MVP)

- Prioritize core features

- Choose offshore or nearshore development teams in South East Asia/ India.

- Use cross-platform development frameworks

📌 Pro Tip: At BiPlus, we're based in Vietnam so we can provide significantly low-cost fintech app development services.

Meet BiPlus: Your fintech app development partner

Our developers excel in Java, Python, and Node.js, enabling us to build comprehensive backend systems.

For mobile development, we leverage Kotlin for Android and Swift for iOS, ensuring native-level performance and seamless user experiences.

In our recent project with a fintech company, we helped them achieve 3x feature release in one year and a 20% revenue increase in payment services.

🎯 You can read our full story here.

Our fintech app development services include:

- Mobile app development

- Back-end development

- User experience (UX) and User interface (UI) design

- Application and network security

- Cloud computing

- Payment processing APIs

- Artificial intelligence and machine learning integration

- Blockchain implementation

Contact Us to discuss your fintech app development, we'd love to meet you.